What is Leverage?

Abstract: The foreign exchange market, the world's largest financial market, sees billions of dollars flowing every day. Behind these transactions, there is a factor that cannot be ignored, that is, foreign exchange leverage. It can both allow investors to small big, but also allow the loss of an instant magnification.

What is Leverage?

First, let's understand what forex leverage is. Simply put, foreign exchange leverage is an operation that uses borrowed funds to conduct foreign exchange transactions. By borrowing from brokers, investors can trade forex on a larger scale. For example, if an investor uses 10x leverage, he only needs to invest $1 to control a trade worth $10. This is like a magnifying glass, which magnifies the possibility of profit, but also magnifies the risk of loss.

In cryptocurrency exchanges, leveraged trading is a way to allow investors to use borrowed funds to increase the size of their trades. Investors borrow another cryptocurrency or fiat currency through leveraged trading and then exchange it into the underlying asset, giving them greater trading power.

In Forex options trading, leverage can sometimes be used to amplify investment returns, but risks need to be carefully assessed and appropriate risk management measures taken.

To get a more complete picture of forex leverage, you need to understand the following.

What is the Margin?

Foreign exchange margin is one of financial derivatives. It is a financial derivative in which a certain proportion of its capital is traded in various currencies in the foreign exchange market, and the value added transaction of the direction of exchange rate fluctuations is expanded by hundreds or even hundreds of times. It is a measure taken by traders to limit the risks they face.

Margin is used to represent a percentage of the total amount of a position, generally speaking, most traders are used to 0.25%, 0.5%, 1%, 2% margin. The margin consists of two parts, the available margin and the occupied margin, the sum of which is the net value in the account. Of course, the margin is not arbitrarily drawn up, it depends on the leverage ratio chosen by the investor, the higher the leverage multiple, the smaller the margin.

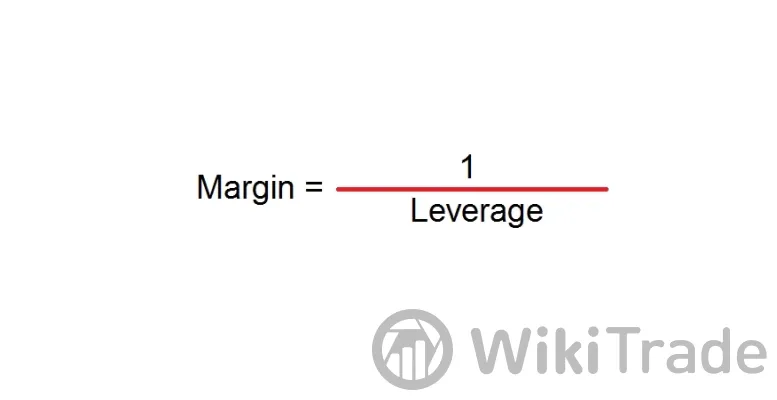

The Relationship between Leverage and Margin

In finance, forex trading is closely linked to leverage. Foreign exchange leverage refers to the multiple of reduced margin use, the greater the leverage, the less collateral demand. In general, there are also requirements for foreign exchange deposits.

When customers conduct foreign exchange margin trading, they need to deposit certain funds as margin, and there are also requirements for foreign exchange margin. To trade forex through a broker, the broker will require the client to deposit a certain amount of money in their trading account as a margin.

Brokers set minimum margin requirements for trades and adjust leverage to control risk based on experience and capital size. Specifically, the total amount of a trade divided by the margin ratio is leverage, so leverage and margin are negatively correlated. Provide more profit opportunities for investors. In Forex leveraged trading, it is crucial to choose reputable companies to ensure the safety of funds and a quick start for beginners.

In the realm of foreign exchange trading, leverage and margin are intricately linked. While they may seem like separate entities, a deeper understanding of their relationship is crucial for successful trading.

| Correlation | Difference |

| Increase the scale of investment | Forex leverage: Borrow another currency to trade Margin: Trade with the funds in the account |

| Amplify potential gains | Forex leverage: Variable ratio Margin: Fixed requirement |

| Both have risk management | Forex leverage: Higher risk Margin: Lower risk |

| Proper forex leverage or margin strategy | Forex leverage:Long-term trades Margin: Short-term trades |

Leverage Calculation Method

In foreign exchange leveraged trading, investors only need to pay a certain percentage of margin to carry out currency pair trading equivalent to tens or even hundreds of times the amount of margin. It is important to note that the ratio of leverage is not determined by the market or the investors themselves, but is set by the brokers providing trading services.

Foreign exchange leverage is calculated as follows:

Total value = margin x leverage

Assuming 100x leverage is used, investors only need to pay 1% margin to get 100% of the trade size.

Leverage ratio banks formula is: (bank assets ÷ deposits) ×100%.

For example, suppose an investor wants to make a $10,000 EUR/USD trade. If 100 times leverage is used, the investor only needs to pay a margin of $100. Specific calculations are as follows:

Total value ($10,000) = $100 x 100 leverage

If market volatility causes the value of the investor's account to decline, the broker will require the investor to supplement the margin to maintain the margin requirement of the account. If the margin is not replenished in time, the broker may be forced to close the position to reduce its risk.

How is Leverage used in Forex?

Foreign exchange margin: It means that customers are required to pay a certain amount of funds as margin in accordance with a certain proportion to ensure the performance of their trading obligations. It is an important means of risk control, which can reduce the risk of default and trading losses. Due to the low volatility of stable foreign exchange objectives, daily fluctuations usually do not exceed 1%. This relatively stable volatility makes the forex market suitable for margin trading.

Contract trading mechanism: The operating mechanism of foreign exchange leveraged margin trading is based on the contract trading mechanism. The investor signs a contract with the broker and trades with the broker's funds. Investors only need to pay a margin, rather than the full amount of the trade, to open a position. This margin is a portion of the investor's own funds, and its proportion determines the multiple of leverage.

Case explanation: If an investor chooses a leverage ratio of 1:100 and has $1,000 of funds, the investor can control the equivalent of $100,000 of trades in the forex market. This means that even if the price changes by only 1%, the investor can make a profit or loss equivalent to 100% of the investment.

Margin trading: Although investors only need to pay a smaller amount, the risk is not reduced, and the profit and loss amount is still the same. In addition, while interest income can be earned, this usually does not compensate for the losses caused by exchange rate fluctuations.

Magnify returns: Leveraged trading can magnify potential returns. By borrowing another currency or underlying asset to trade, investors can control more of the amount traded than the actual funds, amplifying returns.

Expanding trading scale: The use of leverage can reduce the need for margin, so investors can make larger trades with less money. This allows investors to make better use of funds and improve the efficiency of the use of funds.

Increase profit opportunities: Another big advantage of leveraged trading is that it can provide more profit opportunities in the right market environment. For example, when the base currency of a currency pair is expected to appreciate, the base currency can be purchased by borrowing another currency. In this way, additional gains can be made when the base currency appreciates.

High flexibility: By using leverage, investors can adjust their position size in a timely manner according to market conditions and seize market opportunities. This allows investors to be more flexible in responding to market changes.

Losses are amplified: Just as gains from leverage are amplified, so are losses. If the market moves against expectations, investors may face a large loss, which may even exceed the money they actually invested.

Market volatility risk: The foreign exchange market is highly volatile and prices may fluctuate sharply at any time. In leveraged trading, investors need to keep an eye on market trends and bear the risk of market fluctuations.

Improper leverage risk: An inappropriate leverage ratio may expose investors to excessive risks or limit potential returns. Too much leverage may cause investors to be unable to withstand losses in the face of market volatility, while too little leverage may limit investors' potential gains.

Trading platform security risks: Some foreign exchange trading platforms may have security vulnerabilities, resulting in investor capital loss or personal information disclosure. Choosing a regulated and reputable platform is crucial.

Liquidity risk: In some cases, due to the lack of market liquidity, leveraged trading may cause investors to be unable to close positions in a timely manner or close positions at unfavorable prices, resulting in losses.

Policy and regulatory risks: The regulatory policies of the foreign exchange market may change at any time, and certain leveraged trading modes may become unavailable or become riskier due to policy changes.

FXCM——offers leverage up to 400:1. It is known for its fast and stable trade execution.

Gain Group (FOREX.com)——offers leverage up to 400:1. Renowned for its diverse product selection and excellent customer service.

Swissquote——provides leverage up to 500:1. It is trusted to be safe and subject to Swiss regulation.

Interactive Brokers (IB)——offers leverage up to 500:1. Popular for its low cost trading and variety of trading instruments.

Deutsche Bank——offers leverage from 30:1 to 200:1, depending on account type and currency pair. One of the largest banks in Germany, offering a full range of financial services.

Barclays (BCS)——offers leverage from 30:1 to 200:1, depending on account type and currency pair. A large British bank and financial services provider.

HSBC (HSBC)——offers 20:1 to 200:1 leverage, depending on account type and currency pair. A global financial services provider known for its extensive network in Asia and Europe.

Capital size: Investors need to choose the right leverage ratio based on their capital size. If the capital size is small, choosing a higher leverage ratio may lead to insufficient funds in the account and increase the risk of trading.

Risk tolerance: Different investors have different risk tolerance, and choosing the right leverage ratio can balance potential returns and risks.

Trading experience: Novice traders may lack sufficient experience and skill to deal with the risks posed by high leverage, so it is recommended to start with a lower leverage ratio and gradually adapt to market volatility.

Market movements: In times of high market volatility, a higher leverage ratio may result in an account being exposed to greater risk. Therefore, investors need to pay close attention to market movements and adjust their leverage ratio according to the situation.

Choosing a trading platform: First, you need to choose a reliable Forex trading platform. Ensure that the platform is regulated, has a good reputation, and is able to provide leveraged trading services.

Open an account: Open an account on the selected platform. Fill in the necessary personal information, and complete the account opening process according to the requirements of the platform.

Deposit: Deposit funds into your account. Usually, you can do this using a bank transfer, credit card, or other electronic payment method.

Choose the leverage ratio: The leverage ratio determines that you can control a larger trading size with a smaller amount of capital. For example, if you choose a leverage ratio of 100:1, you can control 100% of the trade size with 1% of your own funds.

Select a trading currency pair: Select the currency pair you want to trade. For example, USD/EUR, USD/JPY, etc.

Open a position: Enter the amount and leverage you want to trade on the platform interface, and then open a position. At this point, you have traded forex with the margin.

Monitor market movements: Pay close attention to market movements and exchange rate changes. Use the tools and indicators provided by the platform to analyze market trends and decide when to buy or sell currencies.

Close a position: Close a position to close a trade when you think the exchange rate has reached a satisfactory level. This will close your position and determine your profit or loss.

Withdrawal: Withdrawal of profits or funds from an account. Make sure you meet the platform's withdrawal requirements and restrictions.

Diverse leverage options: Oanda offers a wide range of leverage options, and in general, a leverage ratio of 50:1 or below is suitable for novice traders. This helps novice traders to start with small trades and gradually adapt to the market.

Risk control tools: Complete risk control tools, such as stop loss orders, stop profit orders and position management, to help beginners control risks, reduce losses, and manage capital.

Education and training resources: including novice trading guides, online courses and instructional videos. These resources can help beginners quickly understand the basic knowledge and skills of forex trading, improve the success rate of trading.

Community Support: Oanda's Community Support team provides one-to-one counseling for novices to help them with their trading issues. Other traders in the community can also offer useful experiences and advice to newcomers.

Transparency and real-time quotes: The trading platform provides real-time quotes and historical data, enabling newbies to better understand market dynamics and trends.

Pros and Cons

Through leverage, a trader can control all the funds available for a larger transaction with less funds, thus improving the efficiency of capital use. If the market moves in the direction of the trade, leverage can magnify potential profits several times, allowing traders to earn higher returns.

But it also magnifies the risk of losses. Traders need to accurately judge market movements and appropriate exit points.

Leveraged forex trading has the following pros:

Leveraged Forex trading carries the following risks:

| Pros | Risks |

| Magnify returns | Losses are amplified |

| Expanding trading scale | Market volatility risk |

| Increase profit opportunities | Improper leverage risk |

| High flexibility | Trading platform security risks |

| Liquidity risk | |

| Policy and regulatory risks |

High Leverage Forex Brokers

Some well-known traders offer high leverage for traders to choose from, including: FXCM、Gain Group (FOREX.com)、Swissquote、Interactive Brokers、Deutsche Bank、Barclays (BCS)、HSBC

What Factors should consider when utilizing Leverage?

When choosing the foreign exchange leverage ratio, investors need to consider the following aspects:

How to use Leverage?

Advice for Novice Traders

Before making an actual trade, a novice trader can try a mock trade. It is a way to allow novice traders to trade virtually in a real market environment, which is a way to quickly master the processes and operations of forex leveraged trading without capital risk.

Usually, the trading platform will provide a certain initial virtual capital, such as 10,000, 100,000, etc., to simulate the trading scale of the real market. Traders can trade Forex through a demo account and experience market volatility and the practical application of trading strategies.

Novice traders need to choose the right leverage ratio according to the platform and product, including familiarity with the basic operations and functions of the trading platform, such as: account management, order execution, chart analysis, etc. Pay attention to managing your own risk during trading, set a stop loss and stop profit, and avoid excessive trading.

While simulated trading helps novice traders familiarize themselves with the forex leverage market, there are still differences between the real market environment and the simulated environment. Therefore, simulation trading is only used to accumulate experience, but at the same time, it is also necessary to carefully assess your ability and risk tolerance to prepare for the real market.

Here, we have found a forex trading platform called “Oanda” for novice traders to help novice traders better trade, the platform has the following features:

Conclusion

In conclusion, forex leverage can amplify potential gains and losses in a way that uses a small amount of capital to control larger transactions. As a trader, dealing with risk is key. Traders should have a deep understanding of the characteristics of the forex market, the types of risks and their impact, and make risk assessments based on dynamic information such as market trends, economic news and data releases. On this basis, develop a clear trading plan, including trading goals, stop loss points, entry and exit strategies. At the same time, keeping a calm mind, avoiding emotional trading, and continuing to learn and observe market dynamics are also necessary conditions to improve the success rate of trading.

Top News

WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade