How to add nas100 on mt5?

Abstract: The NASDAQ-100 is one of the most popular indices globally, comprising 100 of the largest non-financial companies listed on the NASDAQ stock exchange.

Understanding NASDAQ-100 trading in forex

The NASDAQ-100 is one of the most popular indices globally, comprising 100 of the largest non-financial companies listed on the NASDAQ stock exchange. Unlike traditional forex pairs, trading the NASDAQ-100 involves speculating on the price movements of this tech-heavy index rather than currencies. Many forex brokers now offer Contracts for Difference (CFDs) on indices like the NASDAQ-100, allowing you to trade on its price movements without needing to own the underlying assets.

When using leverage with a forex broker, the appeal of trading the NASDAQ-100 lies in its high volatility and liquidity. Tech giants like Apple, Amazon, and Microsoft drive the index, meaning news or earnings reports from these companies can lead to significant price swings. As a trader, you can capitalize on these movements, whether you expect the index to rise or fall. However, you must choose a broker that offers competitive spreads, low trading costs, and reliable execution to maximize your potential profits.

Eligibility for NASDAQ-100 inclusion

To understand the NASDAQ-100, it's essential to know what companies make the cut. The index includes the 100 largest non-financial companies listed on the NASDAQ Stock Market, ranked by market capitalization. Companies must be listed exclusively on the NASDAQ, and they must meet specific criteria, including minimum liquidity thresholds and adherence to financial reporting standards.

Moreover, the index undergoes an annual rebalancing, typically in December, to reflect changes in market capitalization and ensure that the most prominent companies remain included. For a company to join the NASDAQ-100, it must demonstrate consistent financial performance, growth, and market interest, having the index a representation of leading sectors like technology, biotechnology, and retail.

How the value of NASDAQ-100 is derived

The value of the NASDAQ-100 index is a weighted calculation based on the market capitalization of its constituent companies. Each company's influence on the index is proportional to its market cap, meaning that larger companies like Apple and Microsoft have a more significant impact on the indexs movements.

The index value is calculated in real-time during market hours, fluctuating with the trading prices of its constituent stocks. The weighting methodology ensures that the performance of the largest companies predominantly drives the index, while smaller companies have a lesser impact. As a trader, understanding this weighting system is crucial since major price movements in the NASDAQ-100 are often tied to the performance of its top-weighted companies.

Why trade the NASDAQ-100 with a forex broker?

Trading the NASDAQ-100 through a forex broker offers several advantages, particularly if you prefer CFD trading. Forex brokers often provide more flexible leverage options than traditional stock brokers, allowing you to amplify your exposure to the NASDAQ-100 with a relatively small initial investment. This flexibility can be a double-edged sword, though, so managing your risk is essential.

Additionally, forex brokers typically offer lower trading costs, including tight spreads and zero commissions, which can enhance your profitability. Another advantage is the ability to trade the NASDAQ-100 outside regular stock market hours, depending on the broker's offering. This allows you to react to global news events that might impact the index, giving you an edge over traders restricted to standard trading hours.

Benefits of CFD trading on NASDAQ-100

CFD trading on the NASDAQ-100 offers a host of benefits. One of the most significant is the ability to go long or short with ease. Whether you believe the NASDAQ-100 will rise or fall, CFDs allow you to profit from either scenario. This is particularly useful during periods of market volatility when prices can swing rapidly in either direction.

Leverage is another key benefit, as it allows you to control a larger position with a smaller amount of capital. However, while leverage can increase potential returns, it also magnifies potential losses, so it's crucial to use it wisely.

Lastly, trading CFDs on the NASDAQ-100 with a forex broker often comes with lower fees and no stamp duty in many jurisdictions, compared to traditional stock trading. This cost-efficiency, combined with the flexibility and accessibility of CFDs, makes them an attractive option for traders looking to capitalize on the movements of one of the worlds most dynamic indices.

Top Forex brokers for trading the NASDAQ-100

Selecting the right forex broker for trading the NASDAQ-100 is crucial for your trading success. Look for brokers that offer tight spreads on the NASDAQ-100, as even small differences in spread can significantly impact your profitability. Also, consider the brokers execution speed, as fast and reliable trade execution can make a big difference in a fast-moving market like the NASDAQ-100.

Another factor is the availability of advanced trading platforms. A good broker should offer platforms with robust charting tools, technical indicators, and the ability to automate trades through expert advisors or algorithms. Finally, ensure the broker is well-regulated, as this provides an added layer of security and peace of mind when trading.

How to start trading the NASDAQ-100 with a forex broker

Starting to trade the NASDAQ-100 with a forex broker is straightforward but requires careful planning. First, youll need to open an account with a broker that offers CFD trading on the NASDAQ-100. Ensure your chosen broker meets your needs regarding spreads, leverage, and trading tools.

Once your account is set up, familiarize yourself with the broker's trading platform. Practice using a demo account if available, to get a feel for the platform and test your strategies without risking real money. When you‘re ready, you can begin trading by analyzing the NASDAQ-100’s market trends, identifying potential entry and exit points, and placing your trades.

Keep in mind that risk management is key. Always set stop-loss orders to protect your capital and never trade with more money than you can afford to lose. With the right approach, trading the NASDAQ-100 can be a lucrative addition to your forex trading portfolio.

What moves NASDAQ the most?

The NASDAQ, or NAS 100, is moved by several factors including share price, trader sentiment, and political events.

Share price: The value of the NAS 100 is a calculation of the share price of each company included in the index. Each company in the NAS 100 is weighted by market capitalization, so the companies with the largest market caps will influence the NAS 100 price the most.

Trader sentiment: Trader sentiment can be both the cause for a change in a companys stock price or a reaction to a change in price that further propels price action.

Political events: Policy changes by governments affecting the business operations of companies included in the NAS 100 can influence a companys profit and thus the underlying share price.

The NASDAQ and US100 are popular stock indices for traders, representing the top 100 companies on the NASDAQ stock exchange. To start trading these indices, youll need to open an account with a broker that offers access to them.

I know you have heard of NASDAQ and may have been looking to add it to your quotes tab on MT5 but have not been able to. It is important to know that not all brokers offer NASDAQ as a tradable instrument. To trade NASDAQ on MT5, you need to create an account with a broker that offers it and then connect your account to MT5.

I will show you how to open an account with a broker that offers NASDAQ as a tradable instrument and then connect the account to MT5 so that you can trade NASDAQ on MT5.

How to Add NAS100 on MT5

Here are steps to add NAS100 on MT5 and get started trading it;

Step 1: Open account with a Broker that offers NAS100

There are few brokers that offer NAS100 as a tradeable stock index. Research and select a reputable broker that aligns with your trading needs and preferences. Two of the most popular brokers that offer NASDAQ are Deriv and Pocket Option.

To open an account on Deriv, visit Deriv's Sign Up page, and you will be brought to a page that looks like this:

Then you can sign up with your email or using your Google account. After signing up, you will be brought to a page that looks like this:

Then click on the get real account button to verify your Deriv account and create real account.

Step 2: Create a Deriv MT5 account

For you to be able to trade NASDAQ using Deriv as a broker, you need to create a Deriv MT5 account and connect it to MT5.

To begin, visit the trader's hub and then scroll down to the CFDs section, then click on a get button as shown below.

Note: My own is showing “open button” because I had created an account before. When you click on a get up, you will be prompted to enter a password. The password is what you will use to connect your account to MT5.

Step 3: Connect your account to MT5

After creating a Deriv MT5 account on Deriv, the next thing for you to connect the account to MT5.

To begin, click on the open button;

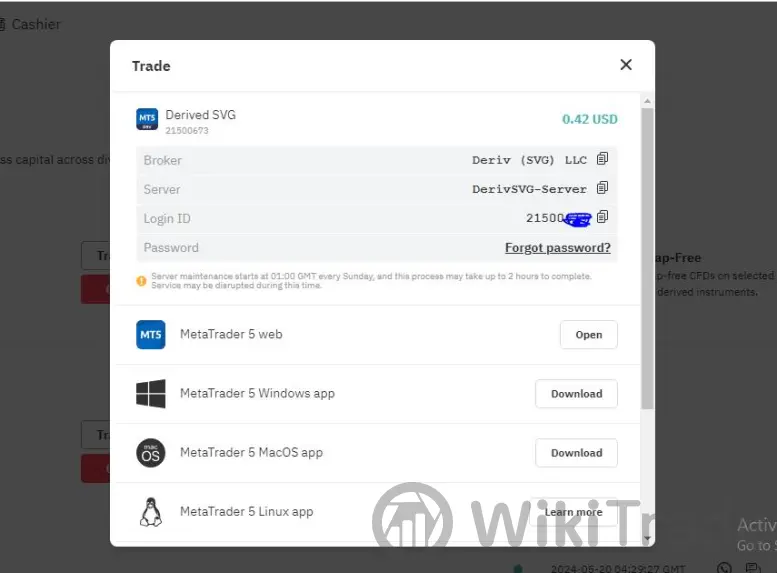

Then you will see your MT5 login details, as shown in the image below:

The you can use the detail to connect your account to MT5. You can follow the video below to learn how to connect your account to MT5.

Step 4: Add NAS100 to the quote tab on MT5

After connecting your Deriv MT5 account to MT5, you can now add NAS100 to the quote tab and then start trading it.

On Deriv MT5, NASDAQ is called US Tech 100. So, if you wanna trade NASDAQ, you need to search for US Tech 100..

To begin, open your MT5 app, Make sure you logged into the Deriv account you connected to MT5, then navigate to the quote tab and click on the “+” button as shown below.

Then scroll down and select stock indices;

Then you will see US Tech 100. tap on it to add to the quote tab. Just like I said before, Another name for NASDAQ is US Tech 100.

Top News

WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade