What is Hedging in Forex?

Abstract: The Forex market, recognized as the largest and most liquid financial market globally, operates around the clock, connecting banks, businesses, and individual traders worldwide. Its core function is to facilitate currency exchanges, essential for global commerce and investment. In this dynamic market, trading involves the simultaneous buying and selling of currency pairs, such as EUR/USD or USD/JPY, where the goal is to speculate on exchange rate fluctuations. \However, this speculation carries inherent risks, as rates can be influenced by economic, political, and market sentiments.

Hedging in Forex

The Forex market, recognized as the largest and most liquid financial market globally, operates around the clock, connecting banks, businesses, and individual traders worldwide.

Its core function is to facilitate currency exchanges, essential for global commerce and investment. In this dynamic market, trading involves the simultaneous buying and selling of currency pairs, such as EUR/USD or USD/JPY, where the goal is to speculate on exchange rate fluctuations. However, this speculation carries inherent risks, as rates can be influenced by economic, political, and market sentiments.

To mitigate these risks, traders employ strategies like hedging, which serves as a protective measure against adverse currency movements.

Hedging involves opening inversely correlated positions or utilizing financial derivatives such as options and futures to balance potential losses in one position with gains in another, akin to insurance.

This article aims to delve deeper into the concept of hedging, highlighting its importance in risk management and its role in formulating a comprehensive Forex trading strategy. By understanding and applying hedging techniques, traders can navigate the complexities of the Forex market with greater confidence and control.

Successful Forex Trading Strategies

Successful Forex trading strategies often involve a combination of technical analysis, fundamental analysis, and risk management techniques. Traders might use strategies like trend following, where they trade in the direction of the market trend, or range trading, where they buy and sell within price ranges.

The key to success in Forex trading lies in a disciplined approach to market analysis, emotional control, and the ability to adapt to changing market conditions, while consistently applying sound risk management principles.

Hedging in Forex encompasses a range of strategies, each varying in complexity and application. The three primary types are direct hedging, complex hedging, and derivatives-based hedging.

Direct Hedging: This involves opening opposite positions on the same currency pair. For instance, holding both a long and a short position in EUR/USD simultaneously. It's straightforward but requires careful management to be effective.

Complex Hedging: This strategy uses multiple currency pairs, often correlating or inversely correlating ones, to offset risks. It's more intricate and requires a deeper understanding of market dynamics.

Derivatives-Based Hedging: Involves using financial instruments like options, forwards, or futures to hedge against currency movements. This method offers greater flexibility but is more sophisticated and riskier.

Options: Options give the trader the right, but not the obligation, to buy (call option) or sell (put option) a currency at a predetermined price before a specific date. For example, if a trader anticipates the EUR/USD pair to rise, they might purchase a call option. If the pair rises above the strike price, the trader profits. Otherwise, the loss is limited to the option's premium.

Forwards: Forwards are customized contracts between two parties to buy or sell a currency at a future date at a predetermined price. They are commonly used by businesses to hedge against currency risk in international transactions. For instance, a U.S. company expecting to receive EUR payments in the future might use a forward contract to fix the exchange rate, thus hedging against the euro weakening against the dollar.

Futures: Similar to forwards but standardized and traded on exchanges. Futures contracts obligate the buyer to purchase, and the seller to sell, a specific amount of currency at a predetermined price on a set date. They are often used by traders to hedge against market volatility. For instance, if a trader holds a portfolio of assets in GBP and fears a decline in its value, they might take a short position in GBP futures, offsetting potential losses in their portfolio.

Volatility Risk: Currency prices can fluctuate wildly due to economic reports, political events, or market sentiment shifts.

Leverage Risk: High leverage can amplify gains, but also losses, leading to rapid account depletion.

Interest Rate Risk: Changes in a country's interest rate can affect its currency value.

Geopolitical Risk: Political instability or policy changes can significantly impact currency markets.

Direct Hedging is effective in mitigating leverage and geopolitical risks due to its straightforward nature, but less effective against volatility and interest rate risks.

Complex Hedging offers better protection against volatility and interest rate changes, leveraging correlations between different currency pairs.

Derivatives-Based Hedging provides the highest level of protection against all types of risks, especially volatility, but at increased complexity and potential costs.

Scenario: In early 2023, Delta Airlines anticipated rising fuel costs due to geopolitical tensions.

Hedging Strategy: They entered into fuel swap agreements, securing a fixed price for jet fuel for a portion of their future needs.

Model-Based Insights: Simulations using oil price forecasting models indicated a high probability of significant price increases, supporting the hedging decision.

Outcome: Oil prices surged in the following months. Delta's hedges protected them from the full impact, saving them hundreds of millions of dollars in fuel costs compared to unhedged competitors.

Scenario: A wheat farmer in Kansas expects to harvest 50,000 bushels in the fall, but fears a price decline before then.

Hedging Strategy: They sell 50,000 bushels of wheat futures contracts, locking in a selling price for their harvest.

Model-Based Insights: Crop yield prediction models and historical price data suggest a potential price drop, making hedging attractive.

Outcome: Wheat prices indeed fall by harvest time. The farmer sells their wheat at the higher price locked in through the futures contract, mitigating losses.

Scenario: A European company has a contract to export goods to the US worth $10 million in 6 months, but worries about a weakening euro.

Hedging Strategy: They buy $10 million worth of euro futures contracts, ensuring a favorable exchange rate when they receive US dollars.

Model-Based Insights: Currency forecasting models indicate a high likelihood of euro depreciation, supporting the hedging decision.

Outcome: The euro weakens as expected. The company converts their US dollar revenue back to euros at the locked-in rate, protecting their profit margins.

Scenario: An investor with a stock portfolio wants to reduce exposure to market downturns.

Hedging Strategy: They allocate a portion of their portfolio to assets that tend to move in the opposite direction of stocks, such as gold or bonds.

Model-Based Insights: Portfolio optimization models suggest that diversification can reduce overall portfolio volatility without sacrificing long-term returns.

Outcome: During a market correction, the investor's diversified portfolio experiences smaller losses than an unhedged portfolio, preserving capital for future growth.

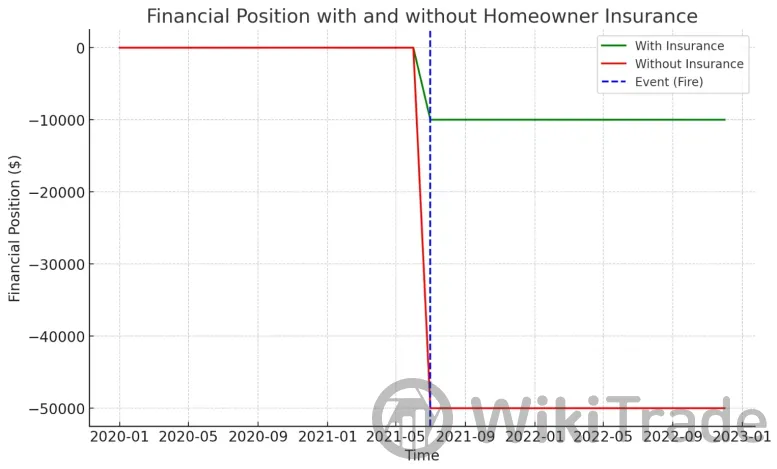

Scenario: A homeowner wants to protect their property against damage from fire or natural disasters.

Hedging Strategy: They purchase homeowner's insurance, transferring the financial risk to the insurance company.

Model-Based Insights: Actuarial models estimate the probability of various events and set insurance premiums accordingly, ensuring the insurer's ability to cover claims.

Outcome: In case of a fire, the homeowner receives compensation for repairs and losses, mitigating financial hardship.

In Volatile Markets:

Scenario: During a period of high volatility, particularly when the USD was experiencing rapid fluctuations due to political uncertainties in the U.S., GlobalTech was concerned about the impact on its revenue generated in USD.

Strategy: The company employed a complex hedging strategy using currency options. It bought put options on USD/EUR, allowing it to sell USD at a predetermined rate.

Outcome: When the USD weakened significantly against the Euro, GlobalTech was able to exercise its options at the favorable strike price, thereby offsetting the losses it would have incurred in converting its USD revenues into Euros. This strategy helped stabilize its earnings.

In Stable Markets:

Scenario: In a phase of relative stability, where the USD and Euro were only experiencing minor fluctuations, GlobalTech's risk of currency loss was lower.

Strategy: The company opted for a direct hedging approach, taking smaller, opposing positions in USD/EUR to safeguard against unforeseen minor fluctuations.

Outcome: This approach allowed GlobalTech to reduce transaction costs while still providing a safety net against unexpected movements. The gains and losses in this case were minimal, but the company maintained more predictable financial results.

Trading Platforms: Platforms like MetaTrader 4 and 5 are widely used for their comprehensive tools that support various hedging techniques. They offer features like advanced charting capabilities, automated trading bots (Expert Advisors), and extensive back-testing environments.

Risk Management Software: Tools like Riskalyze and Mosaic offer tailored solutions for risk assessment and management, essential for formulating hedging strategies. They provide insights into market volatility and potential impacts on currency positions.

Analytical Tools: Applications such as TradingView and Bloomberg Terminal offer real-time market data, news feeds, and analysis, which are crucial for making informed hedging decisions.

Market Prediction Difficulty: Accurately predicting market movements is inherently challenging. Statistics indicate that a significant percentage of traders misjudge market directions, leading to ineffective hedges. For example, studies show that around 70% of private investors lose money on derivative trades, underscoring the difficulty of accurate market predictions.

Costs and Complexity: Hedging strategies, particularly those involving derivatives, can be costly and complex. Reports suggest that transaction fees and spread costs can reduce net gains by up to 20-30%, affecting overall profitability. Additionally, the complexity of these strategies often requires advanced knowledge and experience, creating a barrier for less experienced traders.

Regulatory Compliance: With varying regulations across jurisdictions, about 40% of traders find compliance a significant challenge, impacting the scope and effectiveness of their hedging strategies.

Increased Automation and AI Integration: The incorporation of artificial intelligence and machine learning in trading platforms is set to enhance the efficiency and accuracy of hedging strategies. Predictive models suggest a rise in algorithmic hedging, which can analyze vast market data sets for more precise decision-making.

Greater Regulatory Scrutiny and Compliance: Future trends point towards tighter regulatory frameworks globally. Models predict an increased emphasis on transparency and risk management, impacting the way hedging activities are conducted.

Advancements in Derivative Instruments: Innovation in financial derivatives is expected to continue, offering more sophisticated hedging tools. This includes the development of customized contracts and complex instruments tailored to specific market conditions.

Focus on Sustainability and Ethical Trading: A growing trend is the integration of sustainable and ethical considerations into trading decisions, including hedging. Future models show a potential increase in 'green' hedging products that align with environmental, social, and governance (ESG) criteria.

| Strategy | Risk Level | Cost | Potential Returns | Suitability for Market Conditions |

| Direct Hedging | Low | Low to Moderate | Moderate | Stable markets, low volatility |

| Complex Hedging | Moderate | Moderate | High | Both volatile and stable markets |

| Derivatives-Based | High | High | Very High | Highly volatile markets, experienced traders |

The Role of Derivatives in Hedging

In Forex trading, derivatives play a pivotal role in hedging strategies. These financial instruments, namely options, forwards, and futures, are contracts whose values are derived from the performance of underlying assets, in this case, currency pairs.

These derivatives are instrumental in hedging as they allow traders and businesses to manage their exposure to currency risk more effectively. By locking in prices or profiting from market movements without requiring a direct investment in the currency, they provide flexibility and control in managing foreign exchange risk.

Foreign Exchange Risk Management

Foreign exchange risk management involves strategies to minimize the impact of currency fluctuations on investments and financial transactions. Businesses and investors use various tools such as forward contracts, options, and swaps to hedge against adverse movements in exchange rates.

Effective risk management also entails diversifying currency exposure, regularly assessing the foreign exchange market, and understanding the underlying economic factors that influence currency values. This proactive approach helps in stabilizing cash flows and protecting profit margins from volatile currency movements.

Common Risks in Forex Trading:

Mitigating Risks with Hedging Strategies:

| Risk Type | Direct Hedging | Complex Hedging | Derivatives-Based Hedging |

| Volatility Risk | Moderate | High | Very High |

| Leverage Risk | Low | Moderate | High |

| Interest Rate Risk | Moderate | High | High |

| Geopolitical Risk | Low | Moderate | High |

Each strategy has its strengths, and the choice depends on the specific risk profile and trading objectives of the individual trader.

Cost-Benefit Analysis of Hedging

Hedging in Forex trading involves weighing the costs against the potential benefits to determine its overall effectiveness. Key costs include transaction fees and spread costs, while benefits often manifest in the form of reduced losses and more predictable financial outcomes.

Comparative Table of Costs vs. Benefits:

| Hedging Strategy | Transaction Fees | Spread Costs | Benefits |

| Direct Hedging | Low | Low | Reduces immediate loss risk |

| Complex Hedging | Moderate | Moderate | Protects against market volatility |

| Derivatives-Based Hedging | High | High | High potential for profit, risk control |

Here are some real-world examples of hedging

Airline Fuel Hedging:

Agricultural Commodity Hedging:

Currency Hedging:

Portfolio Diversification:

Insurance:

Hedging in Different Market Conditions

Hedging in Different Market Conditions: A Case Study Approach

Hedging strategies in Forex trading significantly vary between volatile and stable market conditions. To illustrate this, let's examine a case study involving a multinational corporation, GlobalTech Inc., which operates in multiple countries and deals with various currencies.

Case Study: GlobalTech Inc.

These contrasting scenarios demonstrate how hedging strategies can be adapted to different market conditions. In volatile times, more complex and potentially costly strategies like options can provide significant protection, while in stable conditions, simpler strategies like direct hedging offer adequate protection with lower costs.

Regulatory Impact on Hedging Strategies

The effectiveness of hedging strategies in Forex trading can be significantly influenced by regulatory frameworks, which vary across different jurisdictions. These regulations aim to ensure market stability and protect investors, but they can also impact the flexibility and tools available for hedging.

Table Summarizing Major Regulatory Frameworks:

| Region | Regulatory Framework | Impact on Hedging Strategies |

| EU | MiFID II | Stricter reporting requirements; limits on leverage, affecting hedging capacity. |

| USA | Dodd-Frank Act | Mandatory clearing of certain derivatives; restrictions on forex leverage. |

| Asia-Pacific | Varies by country | Diverse approaches; some have liberal policies encouraging hedging, others more restrictive. |

In the EU, MiFID II introduces stringent reporting and transparency requirements, impacting the cost and feasibility of certain hedging strategies.

The USAs Dodd-Frank Act, with its emphasis on derivatives market reform, mandates the clearing of certain over-the-counter derivatives and limits forex leverage, impacting traders' ability to engage in derivatives-based hedging. In the Asia-Pacific region, regulatory approaches vary widely, with some countries like Singapore promoting liberal policies that support hedging, while others impose more restrictions.

Technological Tools

The Forex market has witnessed a significant transformation with the advent of advanced technological tools. These tools range from sophisticated trading platforms to analytical software, aiding traders in implementing effective hedging strategies.

| Tool | Features | User Feedback |

| MetaTrader 4/5 | Advanced charting, EAs, back-testing | Highly favored for versatility |

| Riskalyze | Risk assessment, portfolio analysis | Praised for detailed risk analysis |

| TradingView | Real-time data, charting tools | Popular for user-friendly interface |

Each tool offers unique functionalities catering to different aspects of hedging. MetaTrader is renowned for its all-round capabilities, Riskalyze for its focused risk analysis, and TradingView for its ease of use and real-time data. Selecting the right combination of these tools can significantly enhance a traders ability to execute hedging strategies effectively.

The accompanying illustration visualizes these technological advancements,

Challenges in Hedging: Statistical Overview

Hedging in Forex trading, while valuable for risk management, comes with its own set of challenges and limitations. A statistical overview can shed light on these common issues and their prevalence.

These statistics highlight that while hedging is a powerful tool in Forex trading, it demands a thorough understanding of market dynamics, costs, and regulatory environments.

Future Trends in Hedging

The landscape of hedging in Forex trading is rapidly evolving, driven by technological advancements and changing market dynamics. Recent data and predictive models indicate several emerging trends that are likely to shape the future of hedging strategies.

These trends, as projected by recent data and predictive models, suggest a more technologically advanced, regulated, and ethically conscious approach to hedging in the Forex markets.

Conclusion

In conclusion, the landscape of hedging within Forex trading is constantly shaped by the confluence of advancing technology, evolving regulations, and increasing market intricacies.

To stay ahead, both traders and financial institutions must embrace cutting-edge technologies such as AI and algorithmic trading while adeptly maneuvering through more stringent regulatory environments.

The introduction of novel financial tools and a heightened focus on ethical trading are set to further transform hedging tactics. Looking ahead, hedging strategies are expected to become more refined, effective, and in tune with overarching financial movements, demanding ongoing education and adaptability from everyone involved in the market. This progression highlights the pivotal role of hedging in contemporary Forex trading, underlining its necessity in navigating the complexities of today's financial landscapes.

Reflecting on the discussions in this article, it's evident that the future trends in hedging will necessitate a proactive and informed approach from users, guiding them to not only adapt but also thrive in the evolving world of Forex trading.

Top News

WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade