How to use uniswap?

Abstract: Uniswap is a popular platform for trading cryptocurrencies on the Ethereum blockchain. It's a go-to spot for exchanging tokens, especially those not listed on traditional exchanges. Here's a breakdown of what makes Uniswap tick and how you can use it.

Why UNI is Valuable

UNI, Uniswap's native token, is crucial for the platform's governance. Token holders get a say in the protocol's future, voting on proposals aimed at enhancing Uniswap's ecosystem. The UNI token was introduced to realize a vision of community-driven, self-sustaining growth. If you want a voice in Uniswap's direction, you'll need at least 1% of the total UNI supply.

Why Use Uniswap

Uniswap stands out for its access to a wide array of cryptocurrencies, some of which are exclusive to the platform. It's also a haven for arbitrage seekers looking to capitalize on price discrepancies across different platforms. Plus, it's a gateway for investors interested in Ethereum-based projects.

How Uniswap Works

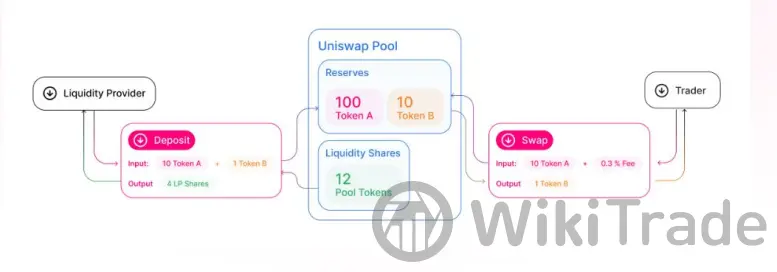

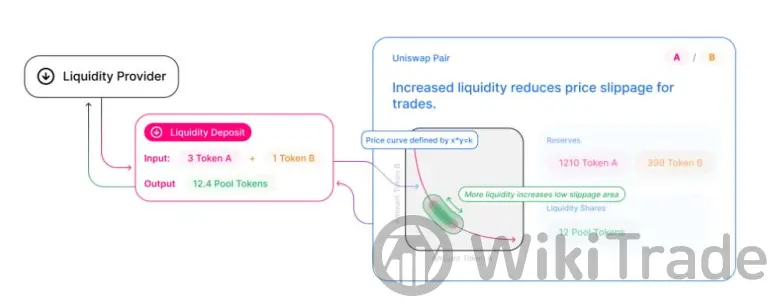

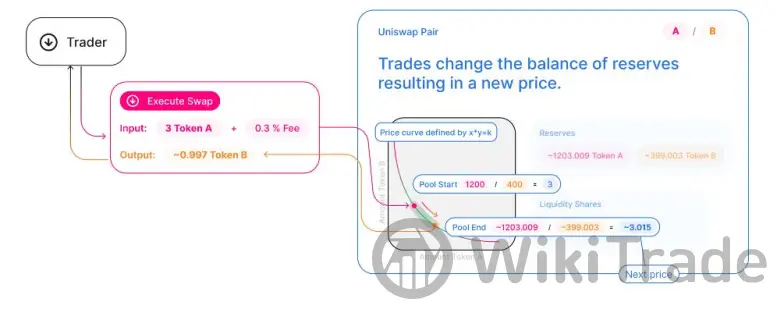

Uniswap operates on a constant product formula, ensuring a balance between two ERC-20 tokens in each liquidity pool. It's an automated system that does away with intermediaries, emphasizing decentralization and security. Anyone can contribute to a pool and earn a share of the transaction fees.

Key Features

- Liquidity Provision: Users can become liquidity providers, earning a portion of the 0.30% fee on every trade.

- Governance: UNI holders can influence the platform's development.

- Decentralized Exchange: Trades happen peer-to-peer without a central authority.

How to Use Uniswap

To get started, you'll need an ERC-20 compatible wallet like MetaMask, WalletConnect, Coinbase Wallet, Portis, or Fortmatic. You'll also need Ether (ETH) to cover transaction fees.

Using Uniswap with MetaMask

- Download and Set Up MetaMask: Install the extension and create a new wallet, noting your Secret Recovery phrase.

- Access Uniswap: Visit uniswap.org and connect your MetaMask wallet.

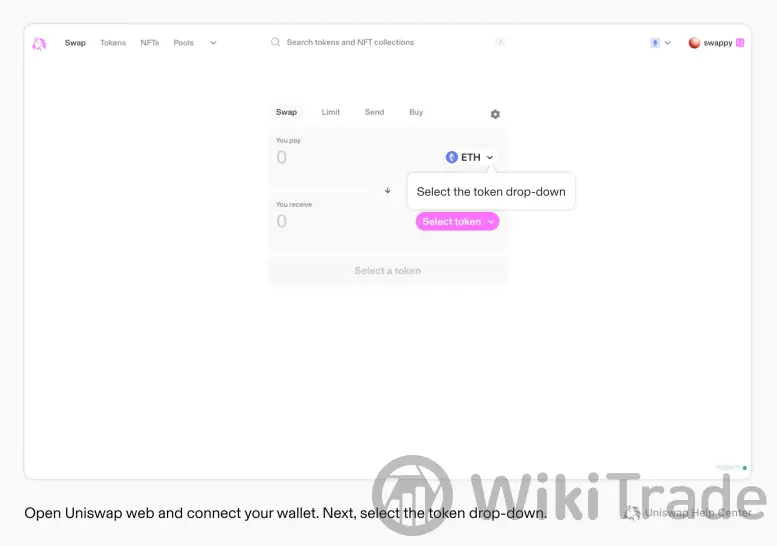

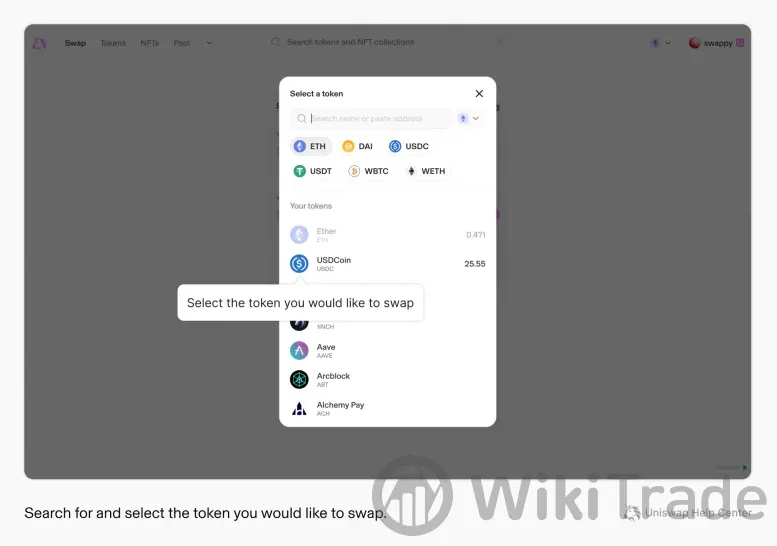

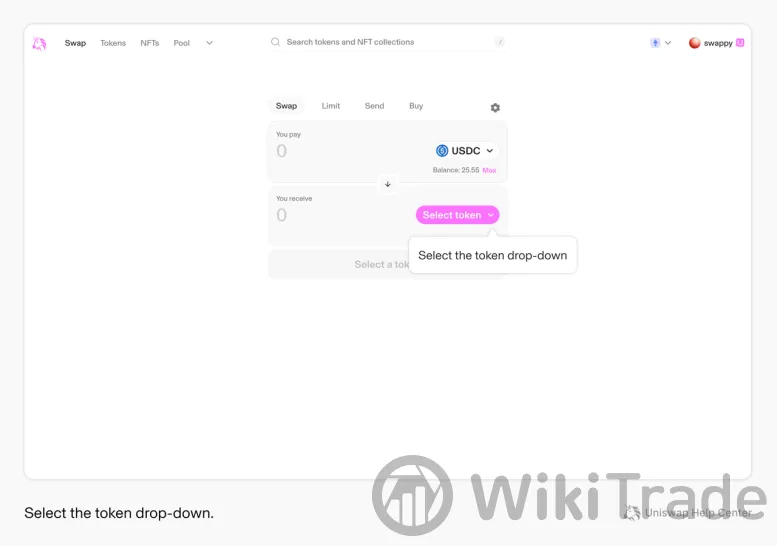

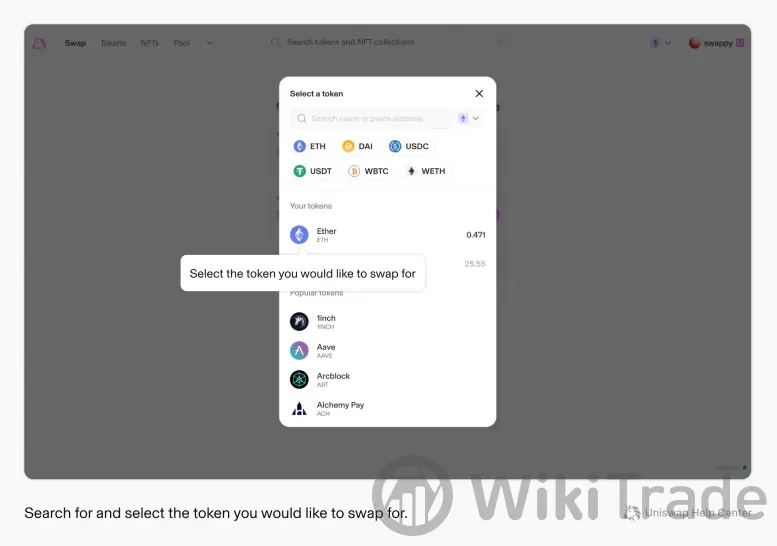

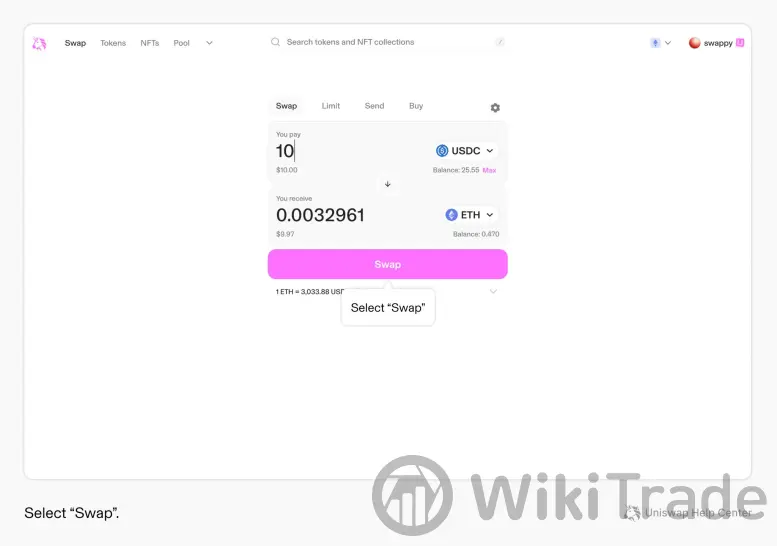

- Swap Tokens: Select the tokens you want to trade and input the amount. Confirm the swap.

- Add Tokens to MetaMask: If it's a new token, you may need to add it to your wallet manually.

- Set Up Trust Wallet: Download and complete the setup.

- Deposit Tokens: Transfer ERC-20 tokens to your wallet.

- Access Uniswap via DApps Explorer: Search for Uniswap and proceed to the swap page.

- Swap Tokens: Search for the desired token and swap as needed.

- Select 'Exchange': Choose the tokens you want to trade.

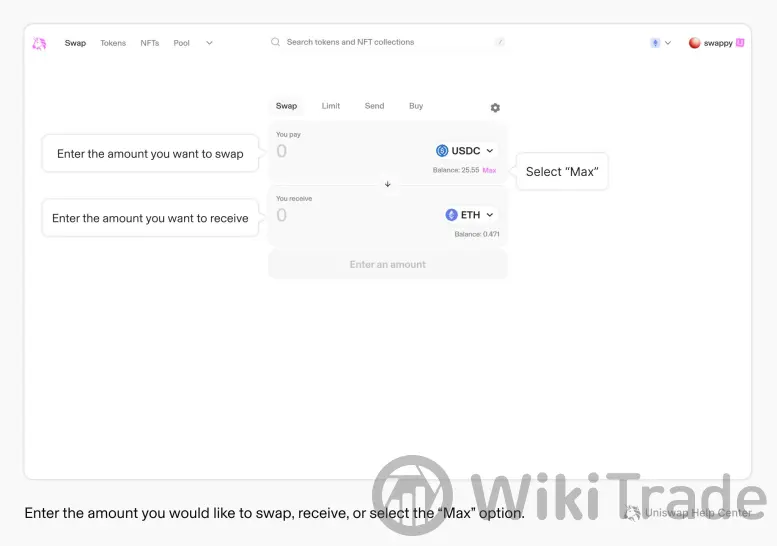

- Enter Amount: Specify how much you want to swap or use the “Max” option for the full balance.

- Confirm Swap: Review and confirm the transaction in your wallet.

- Connect Wallet: Open Uniswap and connect your wallet.

- Select Tokens: Choose the tokens for the swap.

- Enter Amount: Input the amount or select “Max.”

- Swap and Confirm: Follow the on-screen instructions to complete the swap.

- Investing in UNI: Buy UNI tokens on centralized exchanges like Coinbase or through Uniswap using other cryptocurrencies.

- Compatible Wallets: UNI is compatible with various wallets, including Coinbase Wallet, MetaMask, Ledger, and Trezor.

- Security: While considered secure, Uniswap suffered a breach in 2023, highlighting the risk of smart contract vulnerabilities.

- Stuck Transactions: If a transaction is pending for too long, it may have been dropped from the memory pool. Reset your wallet to clear pending transactions.

- Failed Transactions: You won't get gas fees back for failed transactions, but the fees are usually lower than for successful ones.

Using Uniswap with Coinbase

Using Uniswap with Trust Wallet

The process is similar to using it with Coinbase, involving setting up the wallet, depositing tokens, and using the DApps explorer to access Uniswap for swapping.

Exchange Tokens

Web App Usage

FAQs

That's the essence of Uniswap—straightforward, decentralized trading with a community-driven approach. Whether you're swapping tokens or participating in governance, Uniswap has you covered.

Top News

WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade