GMI Forex Broker (Full Review)

Abstract: Established in 2009 and regulated by FCA, GMI (Global Market Index) specializes in providing customers with fast and stable order execution using the latest technology. GMI offers a wide range of tradable assets, including currency pairs, gold, silver, crude oil, and global indices. GMI's business has expanded to over 30 countries, accumulating over 1 million users and 7 trading centers around the world. In addition, GMI provides copy trading services, allowing novice or busy traders to easily profit by replicating the trades of successful traders.

| GMI Review Summary | |

| Broker Name | GMI |

| Full Name | Global Market Index |

| Founded | 2009 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA |

| Market Instruments | Gold, Oil, Silver, Forex, Indices |

| Demo Account | Availiable |

| Leverage | Up to 1:2000 |

| Spread | From 0.0 pips |

| Minimum Deposit | $15 |

| Trading Platforms | GMI EDGE, MetaTrader 4, Multi-Account Manager |

| Base Currencies | USD |

| Customer Support | Tel: +64 9.889.3343 |

| Email: cs.global@gmimarkets.com and cs@gmimarkets.com | |

| Live Chat, Contact Form | |

GMI has considered one of the largest Forex and CFD brokers in the world, has received several industry awards, including Best Global Forex Broker 2023, Most Innovative Broker 2023, Best Trading Platform 2023. You can visit their official website: https://gmimarkets.com/en to learn more about it.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Pros

FCA Regulation: Being regulated by the FCA adds a layer of security and trust for traders.

Wide Range of Assets: Offering various assets such as currency pairs, gold, silver, crude oil, and global indices allows for diversified trading opportunities.

Global Presence: Operating in over 30 countries with 7 trading centers worldwide indicates a strong global presence and accessibility.

Copy Trading Services: Providing copy trading services can be beneficial for novice or busy traders to replicate successful trades.

Low Minimum Deposit: The minimum deposit to open an account with GMI is $15, which is friendly for beginners.

Cons

Limited Payment Methods: Available payment methods are different in different area. And payments methods are limited in all areas. For example, Only Neteller and Skrill are available in Brunei.

Additional Fees for Deposits and Withdrawals: A 3.95% fee will be charged on deposits/withdrawals unrelated to trading with GMI.

Security

GMI, licensed with a Straight Through Processing(STP) License of No.677530, operates under the regulation of the Financial Conduct Authority (FCA). FCA regulation is known for its stringent requirements, which include capital adequacy, segregation of client funds, and regular audits. This regulation provides a level of security and protection for traders' funds.

Market Instruments

GMI offers a wide range of trading instruments, providing traders with the opportunity to trade in different markets and asset classes.

Commodities: GMI allows trading in commodities such as gold, oil, and silver. These commodities are popular among traders due to their liquidity and the potential for price movements driven by global economic factors.

Forex: GMI offers trading in major currency pairs such as the US Dollar, Japanese Yen, Euro, British Pound, Swiss Franc, Australian Dollar, and Canadian Dollar. Forex trading provides opportunities to profit from the fluctuations in exchange rates between these currencies.

Indices: GMI provides CFDs for trading on indices such as the Dow Jones, NASDAQ, S&P 500, FTSE 100, DAX, CAC, NIKKEI, Hang Seng, and China A50. Trading indices allows traders to speculate on the performance of the overall stock market or specific sectors.

Accounts

Demo Account

The GMI Demo Account offers traders a risk-free environment to practice trading and familiarize themselves with the platform's features. With $10,000 in virtual funds, traders have the opportunity to explore different trading strategies, test their risk management techniques, and become familiar with the platform's features, all while gaining valuable experience in the financial markets.

Account Types Comparison

GMI offers three distinct account types—Cent, Standard, Standard Bonus, and ECN—each tailored to meet the diverse needs and preferences of traders. All of the accounts support the expert advisor, social trading, and swap-free.

For beginners, the Cent Account provides a more accessible entry point into trading with its lower minimum deposit of $15 and higher leverage of up to 1:1000. This account allows for smaller trade sizes and is designed to help new traders gain experience in a low-risk environment.

The Standard Account caters to regular traders who want flexibility and ease of use. With a minimum deposit of $25 and leverage of up to 1:2000, this account type offers competitive conditions for trading a wide range of instruments.

The Standard Bonus Account offers a bonus on the deposit amount, providing traders with additional trading capital. However, you should be aware of the conditions attached to the bonus before choosing this account type.

The ECN Account is tailored for experienced traders who require direct market access and prioritize fast execution speeds and tight spreads. This account type is ideal for those who use expert advisors (EAs) and engage in social trading, offering features like high leverage of up to 1:500 and a commission of $4 per lot.

| Account Type | ECN Account | Cent Account | Standard Account | Standard Bonus Account |

| Minimum Deposit | $100 | $15 | $25 | $25 |

| Leverage | Up to 1:500 | Up to 1:1000 | Up to 1:2000 | Up to 1:2000 |

| Commission | $4 per lot | No | No | No |

| Max. Order (MT4) | 500 | 200 | 500 | 500 |

| Max. Order (GMI Edge) | 1000 | N/A | 1000 | 1000 |

| Max. Lot per Trade | 50 | 150 | 50 | 50 |

| Swap Free | Yes | |||

| Suitable for Social Trading | Yes | |||

| Best for | Experienced Traders | Beginners | Regular Traders | Regular Traders |

Spreads & Commissions

GMI offers different spreads for various market instruments. Here we list the spreads for certain market instruments. To get full information, you can visit the official website.

Forex: Spreads for EURUSD, USDJPY, GBPUSD, EURGBP, and EURJPY all start from 0.0 pips.

Indices: With a spread starting from 1.6 pips, trading the U30USD index involves a cost of 1.6 pips added to the buy price or deducted from the sell price. The SPXUSD index has a spread starting from 5.1 pips, which is higher compared to U30USD. NASUSD offers a relatively tighter spread, starting from 0.9 pips, compared to SPXUSD.

| Instrument | Spread (from) |

| U30USD | 1.6 pips |

| SPXUSD | 5.1 pips |

| NASUSD | 0.9 pips |

| D40EUR | 0.6 pips |

| 100GBP | 0.9 pips |

| F40EUR | 1.0 pips |

| HSIHKD | 3.6 pips |

| CHN50U | 6.0 pips |

Gold, Silver, Oil: The XAUUSD (Gold/USD) pair boasts a spread from 0.0 pips, making it an attractive option for traders seeking minimal trading costs when trading gold against the US dollar. Similarly, the XAGUSD (Silver/USD) pair features a competitive spread from 0.1 pips. For traders interested in trading oil, the USOUSD (US Oil/USD) and UKOUSD (UK Oil/USD) pairs offer spreads from 1.2 pips and 1.4 pips, respectively.

| Instrument | Spread (from) |

| XAUUSD | 0.0 pips |

| XAGUSD | 0.1 pips |

| USOUSD | 1.2 pips |

| UKOUSD | 1.4 pips |

| XNGUSD | 0.3 pips |

| XAUEUR | 0.1 pips |

| XAGEUR | 0.8 pips |

When it comes to commissions, GMI charges a commission of $4 per lot for the ECN account. For other accounts, there is no commission.

Trading Platforms

GMI offers a range of trading platforms designed to meet the diverse needs of traders.

One of its key platforms is the GMI EDGE, a proprietary platform that allows traders to access their accounts from anywhere, at any time. With GMI EDGE, traders can trade a variety of instruments, including forex, gold, silver, indices, and more than 70 other instruments. The platform offers seamless ways to deposit, withdraw, and transfer funds, providing traders with a comprehensive trading experience.

For those who prefer the renowned MetaTrader 4 (MT4) platform, GMI provides full support. MT4 is known for its advanced charting tools, technical analysis capabilities, and automated trading features. Traders using MT4 with GMI can create their own trading algorithms or follow other traders' strategies through customizable Expert Advisors (EAs). The platform also offers a seamless connection to the trading platform through the GMI EDGE app, allowing traders to fund their MT4 accounts with ease.

Additionally, GMI offers the Multi-Account Manager (MAM) platform, which is designed for money managers. The MAM platform allows money managers to trade multiple accounts with a single click, automate performance fee billing, and allocate trades based on flexible methods such as lot size, equity, or balance.

Deposits & Withdrawals

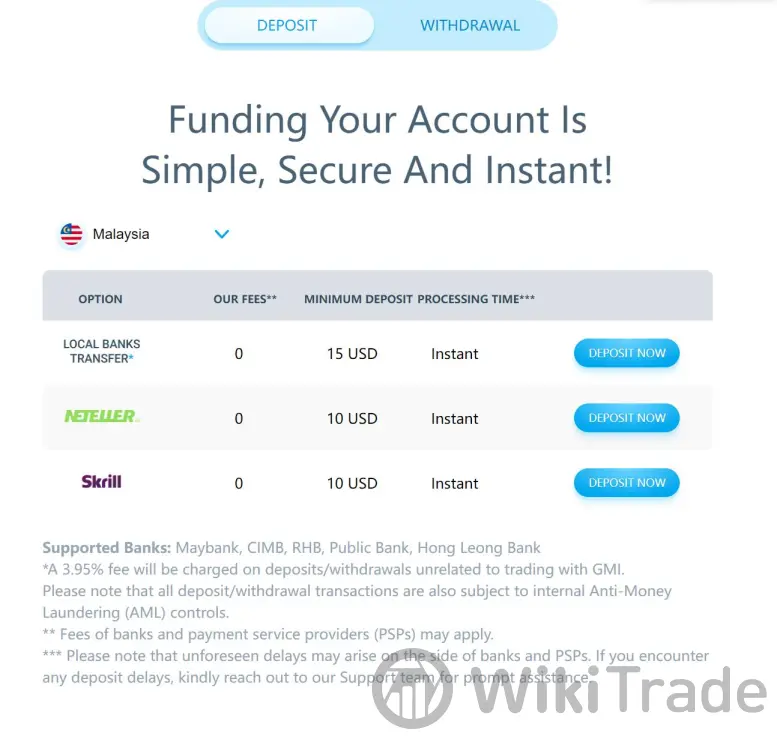

GMI supports different payment methods for deposits and withdrawals. For example, in Malaysia, Local Banks Transfer, Neteller, and Skrill are available. Supported banks includeMaybank, CIMB, RHB, Public Bank, and Hong Leong Bank. Notably, a 3.95% fee will be charged on deposits/withdrawals unrelated to trading with GMI. For more information about the deposits and methods in other areas, you can visit the official website of GMI.

For deposits, traders can use local bank transfers, Neteller, and Skrill, all of which have no deposit fees. The minimum deposit amount for local bank transfers is 15 USD, while Neteller and Skrill have a minimum deposit requirement of 10 USD. Deposits are processed instantly, ensuring that funds are available for trading without delay.

Withdrawals to local banks have no fees, but there is a minimum withdrawal amount of 50 MYR. Withdrawals to Neteller and Skrill incur a 4% fee, with a minimum withdrawal amount of 10 USD for both methods. Withdrawals to local banks are processed between 8 am to 6 pm daily, providing traders with a clear timeframe for when they can expect their funds to be available.

| Payment Method | Fees for Deposit | Minimum Deposit | Processing Time of Deposit | Fees for Withdrawal | Minimum Withdrawal | Processing Time of Withdrawals |

| Local Banks Transfer | $0 | 15 USD | Instant | 0 | 50 MYR | Between 8am to 6pm daily |

| Neteller | $0 | 10 USD | Instant | 4% | 10 USD | Instant |

| Skrill | $0 | 10 USD | Instant | 4% | 10 USD | Instant |

Customer Service

GMI provides comprehensive customer support options to assist traders with any queries or issues they may have.

You can reach the customer support team via telephone at +64 9.889.3343 or through email at cs.global@gmimarkets.com and cs@gmimarkets.com.

Additionally, GMI offers a live chat feature on its website. Furthermore, it also provides a contact form on its website, which you can use to submit inquiries or requests for assistance.

GMIs Awards

GMI has received several industry awards for its services and achievements.

Best Global Forex Broker 2023: This award recognizes GMI as the top-performing forex broker on a global scale in 2023. It highlights GMI's excellence in providing comprehensive forex trading services, including competitive spreads, reliable execution, and exceptional customer support.

Most Innovative Broker 2023: GMI has been recognized as the most innovative broker in 2023 for its pioneering efforts in introducing innovative technologies, tools, and features to enhance the trading experience for its clients. This award underscores GMI's commitment to staying at the forefront of technological advancements in the forex industry.

Best Trading Platform 2023: GMI's trading platform has been honored with the title of the best trading platform in 2023. This award acknowledges the platform's user-friendly interface, advanced trading tools, and seamless execution, making it the preferred choice for traders seeking an optimal trading experience.

Conclusion

In summary, Global Market Index (GMI) is a well-established and regulated forex broker known for its fast order execution and wide range of trading instruments. With over 1 million users across 30 countries, GMI offers copy trading services and has received industry recognition, including awards for Best Global Forex Broker 2023 and Most Innovative Broker 2023.

Overall, GMI provides a reliable and innovative trading experience for traders worldwide. It is a good option when you are considering a forex broker.

FAQs

Q: Is GMI regulated?

A: Yes, GMI is regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

Q: What trading instruments does GMI offer?

A: GMI offers a wide range of trading instruments, including forex, gold, silver, crude oil, and global indices.

Q: What is the minimum deposit required to open an account with GMI?

A: The minimum deposit required to open an account with GMI is $15.

Q: Does GMI offer a demo account?

A: Yes, GMI offers a demo account where traders can practice trading with virtual funds.

Q: What trading platforms does GMI support?

A: GMI supports the GMI EDGE platform, MetaTrader 4, and Multi-Account Manager (MAM) platform.

Q: Does GMI offer Islamic accounts?

A: Yes, all accounts offered by GMI are Islamic accounts, also known as swap-free accounts.

Top News

WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade