How to Trade Electricity Futures?

Abstract: Electricity is a vital part of our modern world, powering everything from homes and businesses to industries and transportation. However, the price of electricity can fluctuate significantly, creating uncertainty for both buyers and sellers. This is where electricity futures trading comes in, offering a way to manage risk and potentially profit from price movements.

Electricity is a vital part of our modern world, powering everything from homes and businesses to industries and transportation. However, the price of electricity can fluctuate significantly, creating uncertainty for both buyers and sellers. This is where electricity futures trading comes in, offering a way to manage risk and potentially profit from price movements.

In this article, we take an in-depth look at the world of electricity futures and give you how to trade electricity futures. Whether you're an energy professional or a curious individual, this article equips you with the knowledge and tools needed to navigate the complexities of electricity futures trading.

Understanding the Electricity Market

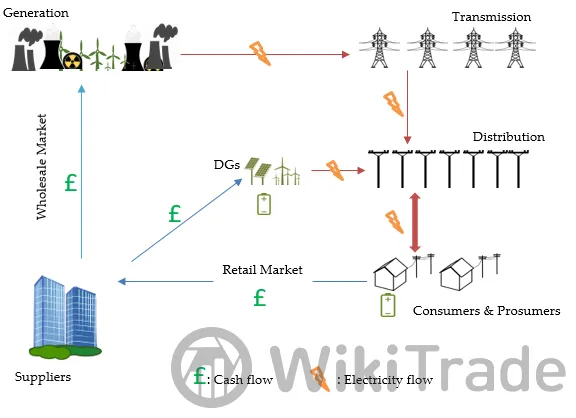

The electricity market is a complex system that involves the generation, transmission, distribution, and consumption of electricity. Understanding the structure of the electricity market is important for traders looking to trade electricity futures.

Generation: Electricity is generated at power plants using various sources such as coal, natural gas, nuclear, hydroelectric, and renewable energy sources like solar and wind. These power plants sell electricity to the wholesale market.

Transmission: The transmission system consists of high-voltage power lines that transport electricity from power plants to local distribution networks. Transmission operators manage the flow of electricity and ensure grid reliability.

Distribution: Distribution networks deliver electricity from the transmission system to homes, businesses, and industries. Distribution companies manage these networks and bill customers for their electricity usage.

Retail: Retail electricity providers sell electricity to end consumers, offering different pricing plans and services. Retail customers can choose their electricity provider in deregulated markets.

Deregulated Energy Markets

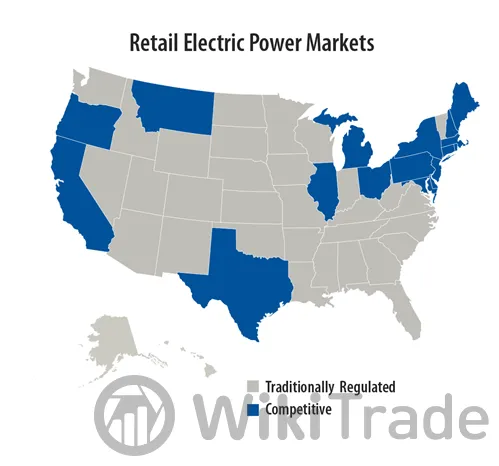

Deregulated energy markets, also known as competitive or open markets, allow for competition among electricity suppliers. In these markets, the generation and retailing of electricity are separated, and consumers can choose their electricity supplier. Deregulation aims to promote competition, lower prices, and encourage innovation in the energy sector. Deregulated markets have different market structures and regulations, depending on the region. For example, some regions have independent system operators (ISOs) or regional transmission organizations (RTOs) that manage the electricity grid and ensure fair and efficient market operation.

In deregulated energy markets, trading electricity futures is a common practice among market participants. One of the main reasons is to manage price risk. Electricity prices can be volatile due to factors such as weather conditions, fuel prices, and demand fluctuations. By using futures contracts, market participants can hedge against price fluctuations and lock in prices for future delivery, reducing their exposure to price risk. Furthermore, trading electricity futures in deregulated markets can promote market efficiency and liquidity. By allowing market participants to trade electricity futures, deregulated markets create a more competitive and dynamic market environment, which can lead to lower prices, increased innovation, and improved market efficiency.

How to Trade Electricity Futures?

Trading in Commodities

Trading commodities—specifically electricity—involves buying, selling, or speculating on the price of electricity. Electricity is a unique commodity due to its intangible nature and the challenges associated with storing and transporting it. However, trading in electricity has become increasingly common with the deregulation of electricity markets in many countries.

In electricity trading, market participants can engage in various types of transactions, including:

Spot Market Transactions: Spot markets allow for the immediate purchase or sale of electricity at prevailing market prices. These transactions are typically for delivery on the same day or within a short timeframe, such as the next hour.

Forward Market Transactions: Forward markets enable participants to enter into contracts to buy or sell electricity at a specified price for delivery at a future date. These contracts can cover longer periods, such as days, weeks, months, or even years, providing price certainty for both buyers and sellers.

Derivatives Trading: Derivatives, such as futures and options contracts, allow participants to hedge against or speculate on future electricity prices.

Trading in Futures

Trading in futures involves buying or selling standardized contracts for the future delivery of a commodity or financial instrument at a predetermined price. Futures contracts are traded on organized exchanges and are used by market participants to hedge against price fluctuations or to speculate on future price movements.

Standardized Contracts

Futures contracts are standardized agreements to buy or sell a specified quantity of a commodity or financial instrument at a specified price on a specified future date. The contract details, such as size, expiration date, and delivery terms, are standardized by the exchange.

Long and Short Positions

A trader can take either a long (buy) or short (sell) position in a futures contract. If a trader expects prices to rise, they can buy a futures contract to lock in a purchase price. If they expect prices to fall, they can sell a futures contract to lock in a selling price.

Purposes of Futures Trading

One of the key purposes of futures trading is risk management. Hedgers, such as farmers and manufacturers, use futures contracts to hedge against price fluctuations in the underlying asset. For example, a farmer might sell futures contracts for the crops they plan to harvest in the future to lock in a price and protect against a potential drop in prices.

Speculators, on the other hand, trade futures contracts with the aim of profiting from price movements. They do not have an interest in the underlying asset itself but seek to capitalize on price changes. Speculators can take long positions (buying contracts in anticipation of price increases) or short positions (selling contracts in anticipation of price decreases).

Method of Settlement

Futures contracts can be settled in two ways: physical delivery or cash settlement. In physical delivery, the buyer is obligated to take delivery of the underlying asset, and the seller is obligated to deliver it, at the predetermined price and date specified in the contract. In cash settlement, the contract is settled in cash based on the difference between the futures price and the market price of the underlying asset at the time of expiration.

How to Trade Electricity Futures?

Electricity futures offer a unique opportunity to manage risk or speculate on price movements in the electricity market.

Step1: Gaining Knowledge

Market Dynamics: Understand factors influencing electricity prices, such as weather patterns, fuel costs, regulations, and demand fluctuations.

Contract Specifications: Familiarize yourself with different contract types, delivery locations, contract sizes, and expiration dates.

Step 2: Choosing a Broker

Select a reputable broker specializing in energy futures trading. They will provide access to trading platforms, market information, and expert guidance.

Step 3: Understanding Margin Requirements

Unlike buying stocks outright, futures contracts require an initial deposit called margin to maintain your position. This margin acts as collateral and can fluctuate based on contract value changes. Be prepared to meet potential margin calls if the market moves against your position.

Step 4: Developing a Trading Strategy

Popular strategies are as below.

Hedging: Protecting against price fluctuations for businesses reliant on electricity.

Trend Following: Capitalizing on upward or downward price trends based on technical analysis.

Mean Reversion: Betting on prices returning to their historical average after significant deviations.

Step 5: Entering the Market

Once you have a solid understanding and chosen a broker, you can place your first trade through their platform. Specify the contract type (buy or sell), quantity, and desired price.

Step 6: Monitoring and Managing Your Position

Actively monitor your positions and market movements. Regularly assess the need to adjust your strategy or exit your position based on market conditions and your risk tolerance. Utilize stop-loss orders to limit potential losses if the market moves against you.

Prices of Electricity Futures

Electricity futures prices are the prices of contracts traded on exchanges, reflecting expectations of future Wholesale Electricity Market Prices (WEPs) at a specific delivery date. These prices are based on market participants' expectations of future supply and demand dynamics, as well as other relevant factors influencing electricity prices.

The relationship between electricity futures prices and WEPs is generally linked, but they are not identical.

Wholesale Electricity Market Prices

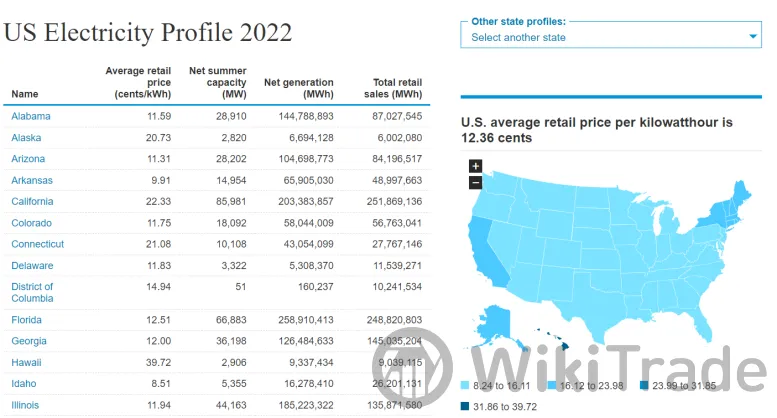

Wholesale Electricity Market Prices (WEPs) represent the cost of electricity bought and sold in bulk by generators, utilities, and other market participants, reflecting real-time prices at which electricity is bought and sold. These prices are determined through a bidding process within electricity markets, which operate under various structures depending on the region.

For example, in the United States, the U.S. Energy Information Administration (EIA) provides data on wholesale electricity prices at various hubs across the country (https://www.eia.gov/electricity/state/).

Factors Influencing Electricity Prices

Supply and Demand: The balance between electricity supply and demand is a key driver of prices. Factors such as weather conditions, economic activity, and generation capacity affect supply and demand dynamics.

Fuel Prices: The prices of fuels used to generate electricity, such as natural gas, coal, and oil, can impact electricity prices. Changes in fuel prices can affect the cost of generation and, subsequently, electricity prices.

Weather: Weather conditions influence electricity demand for heating, cooling, and other purposes. Extreme weather events can lead to spikes in demand and affect prices.

Regulatory Environment: Regulations related to energy markets, emissions, and renewable energy can impact electricity prices by affecting the cost of generation and market structure.

Transmission Constraints: Limitations in the transmission infrastructure can affect the flow of electricity between regions, leading to price disparities.

Market Sentiment: Market participants' expectations and perceptions about future supply, demand, and economic conditions can influence electricity prices.

Renewable Energy: The availability and production of renewable energy sources, such as wind and solar, can impact electricity prices and market dynamics.

Political Factors: Political instability, changes in government policies, and geopolitical events can affect energy markets and prices.

Where can

Where to Trade? - Recommended Electricity Trading Platform

ETRADE Trading Platform

ETRADE is an online broker platform owned by Morgan Stanley, offering a wide range of financial services, including trading in stocks, options, mutual funds, and futures. Founded in 1982, ETRADE is one of the pioneers of online trading and has established itself as a reputable and reliable broker in the industry.

ETRADE Paper Trading

Paper trading on ETRADE refers to the practice of simulated trading in a risk-free environment using a virtual portfolio. This method allows users to test their investment strategies and explore different asset classes. It also allows them to get a feel for real-time market conditions without risking any actual money. By using trading tools provided by ETRADE, individuals can execute trades, track performance, and analyze the outcomes as if they were trading with real funds. This is an excellent way for novice investors to gain confidence and understanding of how the stock market operates before committing actual capital.

ETRADE Futures Account Minimum

ETRADE offers more than 60 futures products listed on the Chicago Mercantile Exchange (CME), Intercontinental Exchange US (ICE US), and the Chicago Futures Exchange (CFE). To trade futures on ETRADE, you'll need a margin-enabled brokerage account or an eligible IRA account that meets the minimum equity requirement of $25,000. While there's no minimum funding requirement for futures trading itself, you'll need sufficient capital to maintain your positions and cover potential margin calls.

How to Trade E mini?

E-mini contracts are futures contracts that represent a fraction of the value of a standard futures contract. They were introduced to make futures trading more accessible to individual investors and traders. The “E” in E-mini stands for electronic, as these contracts are traded electronically on exchanges like the Chicago Mercantile Exchange (CME).

ETRADE now offers trading in E-mini contracts, allowing its clients to participate in futures markets with lower capital requirements and potentially higher leverage. You can trade E-minis like E-mini S&P 500, E-mini Nasdaq 100, E-mini Russell, E-mini S&P Midcap, and more on ETRADE.

Algo Energy Trading Platform

An algorithmic energy trading platform, often referred to as an “algo energy trading platform,” utilizes algorithms to automatically execute energy trades based on predefined parameters. These platforms are designed to optimize trading strategies in energy markets, such as electricity or natural gas, by leveraging computational power to analyze market data, identify trends, and execute trades at optimal times and prices.

PowerBot

PowerBot is an advanced algorithmic trading platform designed for short-term power markets. It offers a range of features to streamline intraday power market operations and maximize trading potential. With built-in trading strategies and a Python framework for custom strategies, PowerBot simplifies the complexities of automated trading. It also provides real-time market data, access to historical orders and trades, and tools for backtesting strategies.

Volue

Volue is a pioneering company in the field of automated short-term energy trading for power and gas markets. They specialize in developing innovative algorithmic trading solutions and quantitative trading strategies for spot markets, aimed at improving business performance for their clients. Volue's approach combines market intelligence with cutting-edge information technology, leveraging years of experience in energy trading along with expertise in capital markets.

How to Become an Energy Trader?

An energy trader, also called an energy broker, is a finance professional who facilitates deals between buyers and sellers of energy assets like natural gas, liquid gas, oil, petroleum and shares of energy grid. The work can be fast-paced, as they track prices, predict trends and follow national and international news that might affect the energy market. Becoming an energy trader typically involves a combination of education, relevant experience, and specific skills.

Education: Obtain a bachelor's degree in a relevant field such as finance, economics, business, or engineering. Some employers may prefer candidates with a master's degree or relevant certifications.

Gain Experience and Develop Skills: Gain experience in financial markets, trading, or the energy industry. This can be done through internships, entry-level positions, or relevant work experience. Develop skills such as analytical thinking, decision-making, risk management, and understanding of energy markets and trading strategies.

Obtain Licenses: Some positions may require licenses, such as the Series 7 for securities traders or the Series 3 for commodity futures traders in the United States. Check the requirements in your country or region.

Apply for Jobs and Career Progression: Look for job openings at energy trading firms, financial institutions, or energy companies. Tailor your resume to highlight relevant skills and experience. As you gain experience, you will have the opportunity to advance to more senior trading positions or take on additional responsibilities in risk management or portfolio management.

Conclusion

In conclusion, trading electricity futures offers a strategic avenue for managing risk and capitalizing on market fluctuations in the dynamic electricity market. Understanding the intricacies of electricity futures trading is essential to hedge against price volatility or speculate on future price movements. By gaining knowledge of market dynamics, selecting a reputable broker, and developing a robust trading strategy, individuals and professionals alike can confidently navigate this market's complexities.

FAQ

Q: What is electricity futures trading?

A: Electricity futures trading works by buying or selling contracts for the future delivery of electricity at a specified price. It allows market participants to hedge against price fluctuations or speculate on future price movements.

Q: What are the benefits of trading electricity futures?

A: Trading electricity futures offers several benefits, including the ability to hedge against price fluctuations, lock in prices for future delivery, and potentially profit from price movements.

Q: What factors influence electricity prices?

A: Electricity prices are influenced by factors such as supply and demand dynamics, fuel prices, weather conditions, regulatory environment, transmission constraints, market sentiment, renewable energy availability, and more.

Q: Are there some popular trading strategies recommended in electricity futures trading?

A: Popular trading strategies in electricity futures trading include hedging, trend following, and mean reversion.

Q: Are there some recommended platforms for trading electricity futures?

A: Some recommended platforms for trading electricity futures include ETRADE and algo energy trading platforms like PowerBot and Volue.

Top News

WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade