Octa Forex Review

Abstract: Octa, formerly known as OctaFX, is a forex broker founded in 2011. They are registered in Cyprus and regulated by the Cyprus Securities and Exchange Commission (CYSEC). Octa offers a variety of trading instruments including forex, stock derivatives, indices, commodities, cryptocurrencies, and shares.

Octa, formerly known as OctaFX, is a forex broker founded in 2011. They are registered in Cyprus and regulated by the Cyprus Securities and Exchange Commission (CYSEC). Octa offers a variety of trading instruments including forex, stock derivatives, indices, commodities, cryptocurrencies, and shares.

You can choose from three platforms: the industry-standard MetaTrader 4 and 5, as well as Octa's own platform, OctaTrader. They also provide various trading tools and resources like calculators, live quotes, and market monitoring. When it comes to account features, Octa offers a minimum deposit of $25, a demo account to practice trading, and negative balance protection to safeguard against losses exceeding deposited funds. You can visit their official website: https://www.octafx.com/ to learn more about it.

| Octa Review Summary | |

| Broker Name | Octa |

| Former Name | OctaFX |

| Founded | 2011 |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC |

| Market Instruments | Forex, Stock derivatives, Indices, Commodities, Cryptocurrencies, and Shares |

| Demo Account | Availiable |

| Leverage | Up to 1:500 |

| Spread | From 0.6 pips |

| Minimum Deposit | $25 |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Octa Trader |

| Trading Tools | Trading calculator, Profit calculator, Pip calculator, Live quotes, Monitoring, and more |

| Mobile Apps | Octa trading app, and Octa Copy Trading App |

| Payment Methods | Visa, MasterCard (Just available for deposits), Neteller, Skrill, Cryptos, and Singapore Local Banks |

| Deposit Bonus | 50% bonus for all deposits exceeding 50 USD |

| Negative Balance Protection | Yes |

| Customer Support | Tel: +357 25 251 973 |

| Email: support@octafx.com | |

| Live Chat | |

| Telegram, Facebook, Twitter, Linkedin, Instagram, and YouTube | |

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Pros:

Solid Experience & Regulation: Founded in 2011, Octa operation under the regulation of CYSEC, indicating a strong regulatory environment.

Rich Educational Resources: They offer a growing library of research materials, including trading ideas, market updates, and third-party analysis, helpful for learning.

Platform Variety: Beyond the standard MT4 and MT5, Octa provides a web platform (OctaTrader) for added flexibility in your trading experience.

Account Options for Different Needs: They cater to diverse needs and platforms with swap-free and Sharia-compliant accounts.

Protection Against Negative Balance: Ensures traders never owe more than the funds they invested, minimizing potential losses due to unforeseen market movements.

Cons:

Exposure on WikiFX: There are 101 pieces of exposure of inability to withdraw or scam on WikiFX, indicating risks in operation.

Security

Octa prioritizes security through regulatory compliance and several measures.

Regulation: Octa is licensed with a Market Making(MM) License of No.372/18 and operates under the regulation of the Cyprus Securities and Exchange Commission (CYSEC). This regulatory oversight helps ensure that Octa follows established guidelines and practices to protect clients' interests.

Negative Balance Protection: Octa offers Negative Balance Protection to its clients as part of its Client Agreement. This protection ensures that clients cannot lose more than their overall account balance, even in volatile market conditions. This measure provides an added layer of security and risk management for traders using Octa's services.

SSL Encryption: Octa uses SSL (Secure Sockets Layer) technology to encrypt and protect personal data and financial transactions, keeping them safe from unauthorized access.

3D Secure Visa Authentication: Octa applies 3D Secure technology when processing Visa credit and debit card transactions, enhancing the security of online transactions.

Market Instruments

Octa offers a wide range of market instruments, including currency pairs, stocks, indices, commodities, and cryptocurrencies, and shares, with competitive trading conditions and a variety of trading options to suit different trading styles and preferences.

Forex: Trade currency pairs with Octa and benefits from tight spreads, high leverage, and free trading ideas. Octa offers a wide range of currency pairs, including all 7 major pairs (e.g., EUR/USD, USD/JPY, GBP/USD) and 28 other pairs.

Stock Derivatives: Diversify your investment portfolio by trading stock derivatives, which are financial instruments whose value is based on the price of an underlying stock. With Octa, you can trade stock derivatives of major companies such as Apple, Tesla, Amazon, and others listed in the U.S., U.K., Europe, Japan, Singapore, and Australia.

Indices: Indices represent the performance of a group of stocks from a particular exchange or market sector. Examples of indices available for trading with Octa include AUS200 (Australia), UK100 (United Kingdom), and FRA40 (France). Trading indices allows you to gain exposure to broader market movements.

Commodities: Enjoy the benefits of trading commodities such as gold, silver, crude oil, and others with Octa. Commodities are physical or raw materials that are traded on financial markets. Trading commodities can provide a hedge against inflation and a way to diversify your investment portfolio.

Cryptocurrencies: Octa offers 30 digital assets for trading, including popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash. Cryptocurrency trading allows you to speculate on the price movements of digital currencies, offering potential opportunities for profit in a volatile market.

Shares: Choose from a selection of over 100 U.S. and European stocks available for trading with Octa. Trade shares of companies such as Apple (AAPL.NAS), Amazon (AMZN.NAS), Tesla (TSLA.NAS), and others. Trading shares allows you to own a stake in a company and benefit from its growth and performance in the stock market.

Accounts

Demo Account

Octa offers a free Forex demo trading account, allowing you to practice Forex trading without any limits. All of the account types support the demo account.

Risk-Free Practice: With Octa's demo account, you can practice your trading skills without the fear of losing real money. The demo account provides you with virtual funds, giving you the opportunity to explore different trading strategies and techniques in a simulated trading environment.

Test New Strategies: Use the demo account to test out new Forex strategies and techniques before implementing them in live trading. This allows you to refine your approach and gain confidence in your trading decisions.

Demo Contest: Join Octa's demo contest to compete against other traders and win real money prizes. This provides an additional incentive to improve your trading skills and performance in a risk-free environment.

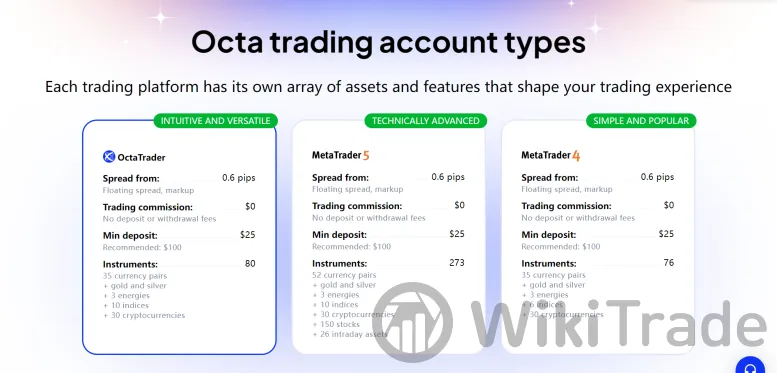

Account Types Comparison

Octa offers three different account types to different platforms. All of the three accounts are swap-free, take a minimum deposit of $25 and allow hedging and scalping. The spreads are floating and start from 0.6 pips.

The account for MT5 offers stocks and even intraday assets alongside the standard forex pairs, metals, energies, indices, and cryptocurrencies available on all accounts. OctaTrader and MT4 provide a slightly more limited selection without stocks and intraday assets.

For traders who prefer to automate their strategies with Expert Advisors (EAs), MetaTrader 5 and 4 are the only options. OctaTrader currently doesn't support them.

| Account Types | OctaTrader | MetaTrader 5 | MetaTrader 4 |

| Floating Spread | From 0.6 pips | ||

| Minimum Deposit | 25 USD | ||

| Trading Instruments | 80 in total, including Forex pairs, Metals, Energies, Indices, and Cryptocurrencies | 273 in total, including Forex pairs, Metals, Energies, Indices, Cryptocurrencies, Stocks, and Intraday assets | 76 in total, including Forex pairs, Metals, Energies, Indices, and Cryptocurrencies |

| Precision | 5 digits | ||

| No Swaps, Halal Trading | Yes | ||

| Minimum Order Size | 0.01 lot | ||

| Maximum Order Size | 50 lots | 500 lots | 200 lots |

| Margin Call / Stop Out | 25% / 15% | ||

| Hedging | Yes | ||

| Scalping | Yes | ||

| Expert Advisors (EAs) | No | Yes | Yes |

Beginners: If you're new to forex trading, OctaTrader's potentially user-friendly interface might be a good starting point. MetaTrader 4 is another option due to its familiarity with some.

Experienced Traders: For a wider range of instruments and the ability to use Expert Advisors, MetaTrader 5 offers the most flexibility.

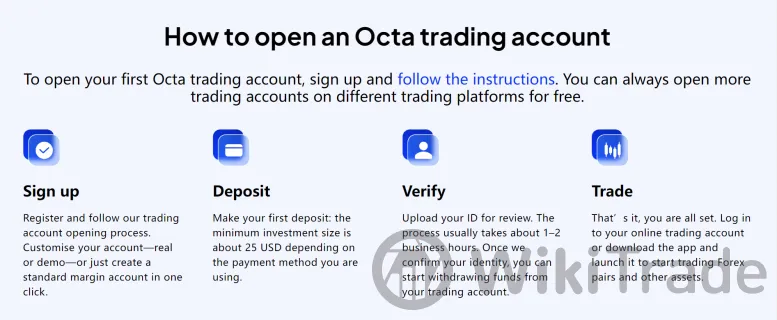

How to Open an Account?

To open an Octa trading account, follow these simple steps:

Sign up

Register and follow the trading account opening process. Customise your account—real or demo—or just create a standard margin account in one click.

Deposit

Make your first deposit: the minimum investment size is about 25 USD depending on the payment method you are using.

Verify

Upload your ID for review. The process usually takes about 1–2 business hours. Once your identity is confirmed, you can start withdrawing funds from your trading account.

Trade

Thats it, you are all set. Log in to your online trading account or download the app and launch it to start trading Forex pairs and other assets.

Leverage

The maximum leverage offered by Octa Forex is different for different trading instruments. Leverage allows you to control a larger position in the market than your initial deposit.

| Asset Class | Leverage Ratio |

| Forex | 1:500 (1:100 for ZARJPY) |

| Metals | 1:200 |

| Energies | 1:200 |

| Indices | 1:200 |

| Cryptocurrencies | 1:100 |

| Stocks | 1:20 |

| Intraday Assets | 1:500 |

Forex: Generally, you can leverage your trades up to 1:500. This means for every $1 you deposit, you can control a position worth $500 (500 times your deposit). However, there's a lower leverage limit (1:100) for the ZARJPY currency pair.

Metals, Energies, and Indices: The maximum leverage is 1:200 for these categories. So, a $1 deposit could control a position valued at $200.

Cryptocurrencies: The leverage limit for cryptocurrencies is set at 1:100.

Stocks: Octa offers a lower leverage of 1:20 for stock trading, which can be less risky compared to higher leverage options.

Intraday Assets: These assets also come with a maximum leverage of 1:500.

Spreads & Commissions

In Octa, there are no commissions, and spreads start from 0.6 pips. However, spreads can vary based on market conditions and time. For more specific details about the spreads offered by Octa, you can visit the website: https://www.octafx.com/spreads/mt5/. Here we list some data about it.

| Trading Instruments | MINIMUM SPREAD | TYPICAL SPREAD | CURRENT SPREAD |

| EURUSD | 0.8 | 0.9 | 1 |

| GBPUSD | 0.8 | 1 | 1.7 |

| USDJPY | 0.9 | 1.1 | 2 |

| USDCHF | 1 | 1.3 | 1.2 |

| AUDUSD | 1 | 1.2 | 1.4 |

| NZDUSD | 0.6 | 1.6 | 1.6 |

| USDCAD | 0.8 | 1.3 | 1.7 |

Trading Platforms

Octa offers three main trading platforms to cater to different trader preferences and needs.

MetaTrader 4 (MT4): MT4 is a widely used trading platform known for its user-friendly interface, advanced charting tools, and automated trading capabilities. It allows traders to execute trades, analyze markets, and develop trading strategies. MT4 is available for Windows, macOS, Android, and iOS devices.

MetaTrader 5 (MT5): MT5 is the successor to MT4, offering additional features and improvements. It includes more timeframes, more technical indicators, an economic calendar, and a depth of market (DOM) feature. MT5 also supports a wider range of financial instruments, including stocks and futures. Like MT4, MT5 is available for Windows, macOS, Android, and iOS devices.

OctaTrader: OctaTrader is a proprietary trading platform developed by Octa. It is designed to be user-focused, offering a one-click trading feature, terminal alerts and notifications, access to brokerage promotions and programs, seamless deposits and withdrawals, and regularly updated analytics. Additionally, it offers an extensive web trading functionality, including different types of charts, popular indicators, visual technical analysis tools, nine timeframes for every style of trading, and a multilingual user interface. OctaTrader can be accessed through the web platform or the Octa trading app on Android or iOS devices.

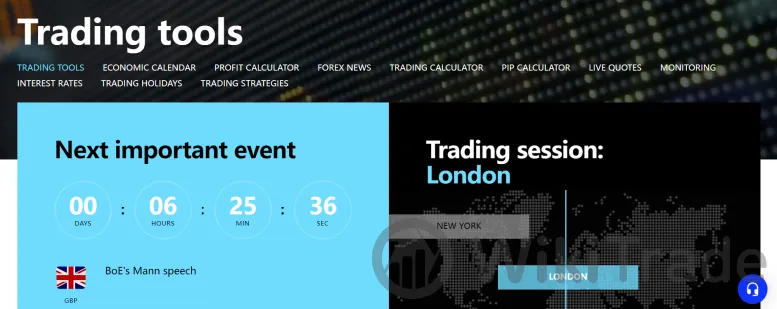

Trading Tools

Octa offers a variety of trading tools to help traders make informed trading decisions and manage their trades effectively.

Trading Calculator: This tool helps traders calculate various aspects of their trades, such as pip value, margin, and potential profit or loss.

Profit Calculator: The profit calculator allows traders to estimate their potential profit based on the parameters of their trade, such as lot size, entry and exit prices, and currency pair.

Pip Calculator: The pip calculator helps traders determine the value of a pip in the currency they are trading, which is essential for risk management and position sizing.

Live Quotes: Octa provides live quotes for a wide range of financial instruments, allowing traders to stay up-to-date with the latest market prices.

Monitoring: Traders can monitor their trading accounts and performance using Octa's monitoring tools, which provide insights into account activity and performance metrics.

Mobile Apps

There are two mobile apps owned by Octa. Both apps are available for download on both Android and iOS devices, making them accessible to a wide range of traders.

The OctaFX Trading App is a powerful tool that allows you to manage your trading accounts directly from your mobile device. With this app, you can easily create new accounts, monitor your existing positions, and execute trades with just a few taps. The app provides access to a wide range of trading tools and features, including real-time market quotes, interactive charts, and a variety of technical indicators.

The OctaFX Copytrading App is designed for traders who want to take advantage of the expertise of experienced traders. With this app, you can automatically copy the trades of successful traders, allowing you to benefit from their knowledge and expertise without having to actively trade yourself. You can also trade as usual and earn additional income by letting others copy your strategy if you are experienced.

Deposits & Withdrawals

OctaFX offers a variety of payment methods for both deposits and withdrawals, including Visa, MasterCard (available for deposits only), Neteller, Skrill, Cryptos, and Singapore Local Banks. Each method has its own minimum amount and execution time, ranging from instant to a few hours. Generally, the minimum amount for deposits is higher than for withdrawals, and the execution time for deposits is shorter than withdrawals.

Additionally, there is a 50% bonus for all deposits exceeding 50 USD. This means that if you deposit more than 50 USD into your trading account, you will receive a bonus equal to 50% of your deposit amount.

| Payment Method | Deposits | Withdrawals | ||

| Minimum Amount | Execution Time | Minimum Amount | Execution Time | |

| Neteller | 50.00 EUR | Instant | 5.00 USD | 1-3 hours to approve, up to 5 minutes to transfer |

| Skrill | 50.00 USD | 5.00 USD | ||

| Litecoin | 0.30000000 LTC | 3-30 minutes | 0.11000000 LTC | 1-3 hours to approve, up to 30 minutes to transfer |

| Dogecoin | 230.00000000 DOGE | 75.00000000 DOGE | ||

| Tether ERC-20 | 50.00000000 USDTE | 10.00000000 USDTE | ||

| Tether TRC-20 | 50.00000000 USDTT | 10.00000000 USDTT | ||

| Ethereum | 0.02000000 ETH | 0.00500000 ETH | ||

| Bitcoin | 0.00037000 BTC | 0.00009000 BTC | ||

| MasterCard | 50.00 EUR | Instant | / | / |

| Visa | 25.00 USD | 1-5 minutes | 20.00 USD | 1-3 hours to approve, up to 1 hour to transfer |

| Singapore Local Banks | 50.00 SGD | 1-3 hours | 10.00 SGD | |

Education Resources

Here are some of the educational resources Octa offers. These are valuable for both novice and experienced traders looking to enhance their trading skills and knowledge.

Webinars: Live or recorded sessions covering various trading topics and strategies.

Forex basics: Articles and video courses providing foundational knowledge about the Forex market.

Platform tutorials: Video tutorials and articles to help you understand how to use the trading platform effectively.

Glossary: A comprehensive list of trading and financial terms with explanations.

FAQ: Frequently asked questions and their answers to help clarify common queries about trading.

Customer Service

OctaFX provides customer support through various channels to assist traders with their inquiries and concerns. You can contact them via telephone at +357 25 251 973 or email at support@octafx.com for direct assistance. Live chat is also available on their website for real-time support.

Additionally, OctaFX is active on social media platforms such as Telegram, Facebook, Twitter, LinkedIn, Instagram, and YouTube, where you can stay updated with their latest news, announcements, and educational content.

Awards Won by Octa

The accolades for OctaFX highlight its strengths in different areas of the trading industry.

Broker with the Fastest Withdrawal Singapore 2023 by International Business Magazine: This award recognizes OctaFX for its efficiency in processing withdrawals, which is crucial for traders looking to access their funds quickly and easily.

Best Educational Broker Global 2023 by World Business Outlook: This award acknowledges OctaFX's commitment to providing educational resources for traders, indicating that they offer valuable materials and tools to help traders improve their skills and knowledge.

Most Reliable Broker Asia 2023 by Holiston Media: Being recognized as the most reliable broker in Asia speaks to OctaFX's reputation for trustworthiness and dependability, crucial qualities in the trading industry.

Most Secure Trading Platform Singapore 2023 by Holiston Media: This award highlights OctaFX's dedication to ensuring the security of its trading platform, which is essential for protecting traders' funds and personal information.

Conclusion

In conclusion, Octa Forex presents itself as a good option for forex traders, particularly those who are new to the market. Their established presence, CySEC regulation, and abundance of educational resources provide a secure and informative foundation for learning. Octa offers a variety of trading platforms, account types, and mobile apps to cater to diverse needs and preferences. Competitive spreads, no commissions, and the option for high leverage can potentially boost returns.

One point that needs consideration is the presence of negative exposure on WikiFX regarding withdrawal issues and safety issues. It's important to figure out these claims before depositing a significant amount of money.

FAQs

Q: Is Octa regulated?

A: Yes, Octa is regulated by CYSEC.

Q: What trading platforms does Octa offer?

A: MT4, MT5, as well as its proprietary Octa Trader platform.

Q: What is the minimum deposit required to open an account with Octa?

A: $25.

Q: Does Octa offer a demo account?

A: Yes.

Q: What payment methods does Octa accept?

A: Octa accepts a variety of payment methods, including Visa, MasterCard (for deposits only), Neteller, Skrill, Cryptos, and Singapore Local Banks.

Q: What trading instruments are available in Octa?

A: Octa offers a wide range of trading instruments, including forex, stock derivatives, indices, commodities, cryptocurrencies, and shares.

Top News

WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade