Is crypto still a thing

Abstract: Cryptocurrency is still a significant player in the financial sphere and technology sector. It continues to attract substantial interest from investors, businesses and governments. Cryptocurrencies like Bitcoin and Ethereum have shown resilience and growth, while new coins also emerge regularly.

What is crypto

Cryptocurrency, often abbreviated as crypto, refers to a category of digital assets that leverage cryptography for transaction security and the regulation of new unit creation. These decentralized currencies operate autonomously, free from the influence of central authorities. Additionally, cryptocurrencies typically adopt an open-source approach, welcoming contributions from individuals interested in their ongoing development.

What is bitcoin

(source: unsplash.com)

Bitcoin is a decentralized digital currency that came into existence in 2009, attributed to an anonymous individual or group known as Satoshi Nakamoto. It operates independently of governmental authorities and financial institutions, relying on a cryptographic protocol. This protocol enables users to seamlessly send and receive funds without the involvement of intermediaries such as banks or payment processors.

The current situation of crypto and bitcoin

The cryptocurrency market has experienced various boom-and-bust cycles over the past decade. The most recent bull run began in late 2020 and extended into early 2021, with Bitcoin surging to an all-time high of nearly $65,000 in April.

However, following that, there was a substantial correction in the market, resulting in many cryptocurrencies losing a significant portion of their value.

Is crypto still a thing

Despite a recent market downturn, the cryptocurrency industry remains robust and promising. Many experts predict that the current dip is a temporary setback, and the long-term outlook for the market is positive. Bitcoin, in particular, continues to be the most valuable and widely-used cryptocurrency worldwide, with a market capitalization of over $800 billion.

Cryptocurrencies have made significant progress since the inception of Bitcoin in 2009. Throughout the years, they have encountered various challenges, undergone substantial price fluctuations, and witnessed remarkable technological advancements.

Initially, cryptocurrencies were primarily embraced by tech enthusiasts and individuals seeking an alternative to traditional financial systems. Bitcoin emerged as the frontrunner among cryptocurrencies and gradually gained recognition and value. However, it was in 2017 that cryptocurrencies truly entered mainstream consciousness during a massive bull run.

During the 2017 bull run, Bitcoin surged to nearly $20,000, and many other cryptocurrencies experienced similar growth. This period also marked a surge in initial coin offerings (ICOs), which are crowdfunding methods used by startups to raise funds through issuing their own tokens. ICOs became a popular means for investors to participate in the crypto market, leading to rapid expansion.

However, the euphoria of 2017 was short-lived. In early 2018, the market entered a prolonged bear cycle, and cryptocurrencies experienced a significant price correction. Many ICO projects turned out to be scams or failed to deliver on their promises, leading to a loss of Despite the challenges and regulatory crackdowns, the crypto market has demonstrated resilience. It has gradually matured and garnered the attention of institutional investors who recognize the potential of blockchain technology. Platforms like Ethereum have emerged as hubs for decentralized applications and smart contracts, unlocking new opportunities across industries.

In recent years, there has been a renewed surge in interest and adoption of cryptocurrencies. Notably, prominent companies such as Tesla and PayPal have embraced cryptocurrencies as a form of payment, indicating a growing acceptance within the mainstream. Furthermore, governments and central banks worldwide are exploring the development of their own digital currencies, known as central bank digital currencies (CBDCs). This exploration reflects the evolving landscape of digital finance.

The market has also witnessed the rise of decentralized finance (DeFi) platforms, which aim Decentralized finance (DeFi) platforms have emerged to provide traditional financial services such as lending, borrowing, and trading in a decentralized manner. These platforms utilize smart contracts and blockchain technology to establish open and permissionless financial systems.

Is bitcoin dead

Lets review its story: When Bitcoin was first launched in 2009, it had no inherent value and was not traded on any exchanges. However, in October of that year, someone offered to buy 10,000 Bitcoins for $50. The offer was accepted, and this became the first recorded transaction involving Bitcoin. At the time, the price of one Bitcoin was less than a penny.

The cryptocurrency market, including Bitcoin, is known for operating in cycles. Periods of explosive growth are often followed by market corrections, which can create a perception of decline. However, it is important to recognize that these adjustments are a natural part of market dynamics and do not necessarily signify the death of Bitcoin or cryptocurrencies as a whole.

Throughout its existence, Bitcoin has faced criticism and regulatory challenges. Areas for improvement, such as energy consumption, scalability, and potential illicit activities, have been highlighted. Nevertheless, these challenges have also spurred innovation and prompted the development of solutions to address these issues.

Despite these challenges, Bitcoin's value proposition as a decentralized digital currency and store of value remains relevant. It continues to attract institutional investors, companies, and individuals who believe in its long-term potential. Furthermore, ongoing developments, including the Lightning Network, aim to improve scalability and transaction speed, addressing some of the concerns associated with Bitcoin.

However, the future of Bitcoin is uncertain, as with any emerging technology or asset class.While Bitcoin may encounter obstacles and face criticism, writing it off entirely would overlook its resilience, continued adoption, and the ongoing efforts to enhance its technology and ecosystem.

The technology behind crypto makes it a thing

Crypto is still a thing due to the technology behind it as the technology continues to make them a valuable innovation. The underlying blockchain technology provides a secure and transparent way to record transactions, free from the influence of centralized authorities. This distributed ledger system has the potential to transform how we exchange value, with the added benefits of increased efficiency and reduced transaction costs. As such, the technology behind crypto is what makes it still a relevant and impactful innovation in today's world, with new applications and use cases emerging every day.

| Advantages | Description |

| Decentralization | Blockchain operates without a central authority, enhancing transparency and reducing the risk of manipulation or censorship. |

| Security | Blockchain uses cryptographic techniques to secure transactions, providing a high level of security and data integrity. |

| Transparency | All transactions recorded on the blockchain are visible to participants, reducing the need for intermediaries and building trust. |

| Efficiency and Speed | Blockchain enables peer-to-peer transactions, streamlining processes and reducing costs compared to traditional systems. |

| Programmable Smart Contracts | Blockchain allows for the creation of self-executing contracts, automating processes and enhancing efficiency in business interactions. |

While there are numerous advantages to the current technological foundation of cryptocurrency, there are also challenges that provide valuable guidance for the field of information technology.

| Disadvantages | Description |

| Scalability | Blockchain networks face challenges in processing a large number of transactions, potentially causing delays. |

| Energy Consumption | Some blockchain networks require significant computational power and energy consumption, raising environmental concerns. |

| Regulatory Challenges | The decentralized nature of blockchain poses challenges for regulators in enforcing regulations and addressing concerns. |

| User Responsibility | Blockchain transactions are irreversible, placing responsibility on users to secure their digital wallets and exercise caution. |

Utility and Adoption of crypto: invalueable

(source: unsplash.com)

The utility and adoption of cryptocurrencies have experienced substantial growth over the years. Despite the challenges they face, crypto is still a prominent force in the digital world. Initially recognized for their decentralized nature, cryptocurrencies such as Bitcoin gained popularity as a digital medium of exchange. Below is a comprehensive overview of the broad utility and increasing adoption of cryptocurrencies:

Cross-Border Transactions: Offering faster and cheaper cross-border transactions, compared to traditional banking systems, crypto eliminates the need for intermediaries, such as banks or remittance services, reducing transaction fees, which is particularly beneficial for individuals and businesses.

Decentralized Finance (DeFi): DeFi refers to the use of blockchain and cryptocurrencies to recreate traditional financial systems without intermediaries, enabling various financial services, including lending, borrowing, trading, and asset management.

Non-Fungible Tokens (NFTs): NFTs are unique digital assets that can represent ownership or proof of authenticity of digital or physical items. They have gained significant attention in areas like digital art, collectibles, gaming, and virtual real estate.

Micropayments and Microtransactions: Cryptocurrencies also facilitate micropayments, allowing for small-value transactions that are not cost-effective using traditional payment systems, which opens up new possibilities for content creators, online platforms, and the gig economy, where small payments can be made efficiently and at lower costs.

Financial Inclusion: Cryptocurrencies have the immense potential to revolutionize financial services for the unbanked and underbanked populations around the world. By simply owning a smartphone and having internet access, individuals can now become active participants in the global financial ecosystem, gaining access to essential banking services and securely storing their wealth.

Smart Contracts and Automation: Cryptocurrencies like Ethereum introduced the concept of smart contracts, which are self-executing contracts with predefined rules and conditions. Smart contracts automate processes, eliminating the need for intermediaries and enhancing efficiency in various industries.

Institutional Adoption: The growing recognition of cryptocurrencies potential by traditional financial institutions, such as banks, asset management firms, and payment processors, is becoming increasingly evident. These institutions are actively embracing the cryptocurrency space by providing custodial services for digital assets, introducing investment products centered around cryptocurrencies, and integrating blockchain technology into their existing operations.

Central Bank Digital Currencies (CBDCs): Several countries are exploring the development of Central Bank Digital Currencies, which are digital representations of a nation's fiat currency issued by the central bank. CBDCs aim to combine the benefits of cryptocurrencies, such as fast and secure transactions, with the stability of traditional fiat currencies. They can enhance the efficiency of monetary systems and enable greater control over the flow of money.

Peer-to-Peer Marketplaces: Cryptocurrencies play a pivotal role in enabling peer-to-peer marketplaces that empower individuals to engage in direct buying, selling, or trading of goods and services, eliminating the need for intermediaries.

Privacy and Security: Cryptocurrencies provide enhanced privacy and security compared to traditional financial systems. Additionally, the underlying blockchain technology offers robust security through cryptographic algorithms, making it difficult for unauthorized parties to manipulate or tamper with transaction records.

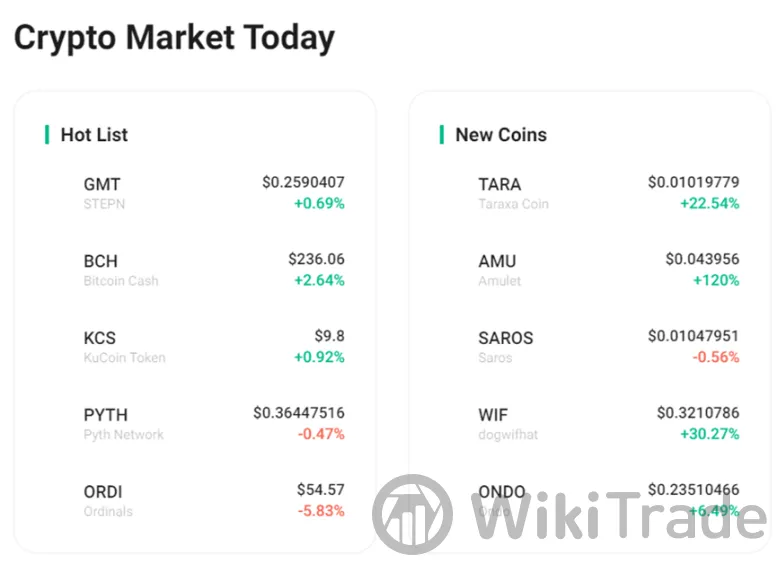

Other worth-noting top digital coins

While Bitcoin is undoubtedly the most well-known and influential digital coin, there are several other top ones with unique features and potential:

Ethereum (ETH): A decentralized blockchain platform that enables the creation of smart contracts and decentralized applications (DApps). It has its native cryptocurrency called Ether, used for transactions and computational services on the network.

Ripple (XRP): Aiming at facilitating fast and low-cost international money transfers, it operates on a decentralized platform that enables secure, instant, and direct transfer of money between individuals or financial institutions using its native cryptocurrency, XRP.

Litecoin (LTC): Launched in 2011, Litecoin is often referred to as the silver to Bitcoin's gold. It offers faster block generation times and a different hashing algorithm, making it more suitable for everyday transactions.

Cardano (ADA): A blockchain platform that aims to provide a more secure and sustainable infrastructure for the development of decentralized applications and smart contracts. Its cryptocurrency, ADA, can be used for staking and participating in the network's governance.

Binance Coin (BNB): Binance Coin is the native cryptocurrency of the Binance exchange, one of the largest cryptocurrency exchanges globally. It offers various utility functions within the Binance ecosystem, including discounted trading fees and participation in token sales.

Polkadot (DOT): A multi-chain platform that allows different blockchains to interoperate and share information.

Where can you trade crypto currency

(source: Kucoin)

Investors are attracted to cryptocurrencies for multiple reasons. One key factor is the potential for high returns on investment, which has garnered significant interest from individuals and institutions alike. Cryptocurrencies have demonstrated the ability to deliver substantial profits, particularly during bull markets. For investors who seek a fortune, crypto is always a thing.

Cryptocurrencies can be traded on a variety of online platforms, including cryptocurrency exchanges, brokers, and peer-to-peer marketplaces. Here are some famous exchanges:

| Exchange | Description | Website |

| Binance | One of the largest and most popular cryptocurrency exchanges globally. It offers a wide range of cryptocurrencies for trading, advanced trading features, and has a user-friendly interface. | Binance |

| Coinbase | A well-known cryptocurrency exchange that is beginner-friendly. | Coinbase |

| Kraken | A reputable cryptocurrency exchange that offers a wide range of cryptocurrencies, including Bitcoin, Ethereum, and others. It has a strong focus on security. | Kraken |

| Bitstamp | One of the oldest cryptocurrency exchanges known for its robust security measures. | Bitstamp |

| eToro | A social trading platform that allows users to trade cryptocurrencies, stocks, and other assets. Offers a unique feature called “CopyTrading” where users can automatically copy the trades of successful traders. | eToro |

| Gemini | A regulated cryptocurrency exchange based in the United States. Provides a secure platform for trading Bitcoin, Ethereum, and other cryptocurrencies. | Gemini |

| KuCoin | A cryptocurrency exchange that offers a wide range of cryptocurrencies for trading. It has a user-friendly interface and provides various trading features. | KuCoin |

Is it a good time to invest in crypto

(source: Gemini)

As with any investment, it is difficult to predict the future performance of cryptocurrencies. However, many experts believe that the recent downturn in the market may present a buying opportunity for those who believe in the long-term potential of the technology.

Important factors about investing in crypto

Research: Before investing in any cryptocurrency, it is essential to educate yourself on the technology, market trends, and potential risks. Consider reading whitepapers, following relevant news sources, and seeking advice from reputable experts.

Volatility: Cryptocurrencies are known for their high volatility, meaning that their prices can fluctuate rapidly and dramatically. Consider your risk tolerance and investment goals before investing in any cryptocurrency.

Diversification: It is important to diversify your portfolio by investing in multiple cryptocurrencies, as well as traditional assets such as stocks and bonds. This can help mitigate risk and provide a more stable return on investment.

Security: Cryptocurrency exchanges and wallets are vulnerable to cyber attacks and hacks, so it is crucial to take security measures seriously. Consider using offline cold storage wallets and multi-factor authentication to protect your assets.

Regulations: Cryptocurrencies operate in a regulatory grey area, and regulations can change rapidly. Keep up with the latest regulatory developments and ensure that your investments comply with applicable laws and regulations.

Liquidity: Some cryptocurrencies may have low liquidity, meaning that it can be challenging to buy or sell them quickly without impacting the price. Consider the liquidity of a cryptocurrency before investing, particularly if you need to sell quickly.

Community: The cryptocurrency community plays a significant role in the success of a particular project. Consider the strength of the community, including its developers, investors, and supporters, before investing in a particular cryptocurrency.

Crypto: the moment to come back

When investing in cryptocurrencies, timing and platform selection are both crucial factors. While market predictions are never certain, many analysts believe that the current crypto market is oversold, which could potentially lead to a market rebound in the near future. Here are some of their opinions:

Institutional Adoption: The trend of institutional adoption of cryptocurrencies is expected to continue growing in 2024, potentially leading to increased legitimacy, liquidity, and stability in the crypto market.

Central Bank Digital Currencies (CBDCs): In 2024, the development and implementation of CBDCs may progress further, potentially impacting the broader cryptocurrency landscape.

Regulatory Frameworks: In various jurisdictions around the world, governments and regulatory bodies are actively working on establishing clearer regulatory frameworks for cryptocurrencies. This may lead to improved investor protection and market stability.

DeFi Evolution: Decentralized finance (DeFi) platforms may continue to evolve in 2024, offering a wider range of financial services, improving user experience, and addressing scalability issues.

Interoperability and Cross-Chain Solutions: In 2024, interoperability between different blockchain ecosystems and cross-chain solutions may become more prevalent, enhancing connectivity and allowing seamless transfer of assets.

Environmental Concerns and Sustainability: In response to the environmental impact of cryptocurrency mining, there may be increased efforts to develop more sustainable and energy-efficient mining practices in 2024. Additionally, eco-friendly cryptocurrencies may gain more attention.

Scams in crypto: Unpleasant thing

(source: unsplash.com)

Unfortunately, the cryptocurrency market has also been plagued by scams and frauds. Where there is wealth, there is cheating. Some common scams include Ponzi schemes, fake ICOs, and phishing attacks are as follows:

Pozi Scheme: A type of investment scam where returns are paid to earlier investors using the capital contributed by new investors, rather than from profits earned by the investment. The scheme relies on attracting new investors to generate returns for earlier investors and keep the scheme going.

Fake ICOs (Initial Coin Offerings): fraudulent fundraising campaigns that claim to offer a new cryptocurrency or token to investors. These schemes aim to exploit the popularity and potential profitability of ICOs by tricking unsuspecting investors into contributing funds to a non-existent or worthless project.

Phishing: Phishing involves fraudsters sending deceptive emails, messages, or websites that appear to be from a trusted source, such as a cryptocurrency exchange or wallet provider. They aim to trick users into revealing their login credentials or private keys, allowing scammers to access their funds. Always double-check the legitimacy of any communication and avoid clicking on suspicious links.

Pump and Dump Schemes: Fraudsters artificially inflate the price of a low-volume cryptocurrency using false information or coordinated buying, and then sell their holdings at the inflated price, causing the price to crash and leaving other buyers with losses.

How to avoid scams in crypto

Research Projects and Teams: Before investing in a specific cryptocurrency project or participating in an initial coin offering (ICO), conduct thorough research. Look for information about the project's whitepaper, team members, advisors, and their previous experience. Check if the project has a legitimate use case, partnerships, and a well-defined roadmap. Be cautious if there is limited information or if the team's credentials cannot be verified.

Verify Exchanges and Wallets: When selecting a cryptocurrency exchange or wallet provider, ensure they have a reputable and secure reputation. Check for regulatory compliance, user reviews, and overall platform reputation. Avoid using unknown or untrusted platforms, as they may be vulnerable to hacks or exit scams.

Be Wary of Unrealistic Promises: Exercise skepticism towards any investment opportunity that promises unrealistic returns or guarantees. Cryptocurrency investments, like any other asset class, come with risks. Avoid schemes that use high-pressure tactics or make claims that sound too good to be true. If it seems too good to be true, it probably is.

Secure Your Private Keys: Ensure that you have full control of your private keys or seed phrases when using a cryptocurrency wallet. By controlling your private keys, you have sole ownership and control of your funds. Avoid sharing your private keys or sensitive information with anyone, as this could lead to theft or unauthorized access.

Use Two-Factor Authentication (2FA): Enable two-factor authentication on all your cryptocurrency accounts and wallets whenever possible. 2FA adds an extra layer of security by requiring a secondary verification method, such as a mobile app or SMS code, in addition to your password.

Be Cautious of Phishing Attempts: Remain vigilant against phishing attempts, where scammers impersonate legitimate websites or services to steal your login credentials or private keys.. Double-check email senders and be cautious of unsolicited communication asking for personal information or funds.

FTX

To embark on your cryptocurrency journey, consider exploring FTX, a renowned cryptocurrency exchange established in 2019. FTX has gained significant popularity due to its user-friendly interface and cutting-edge product offerings. (https://restructuring.ra.kroll.com/FTX/)

Top News

WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade