How much is crypto worth right now?

Abstract: The value of cryptocurrency, such as Bitcoin or Ethereum, fluctuates regularly due to market conditions, making it difficult to provide a precise current value. Crypto prices are impacted by factors such as supply and demand, investor sentiment, and regulatory news. For real-time values, it's best to refer to a reliable financial news or cryptocurrency exchange platform.

(source: Google.com)

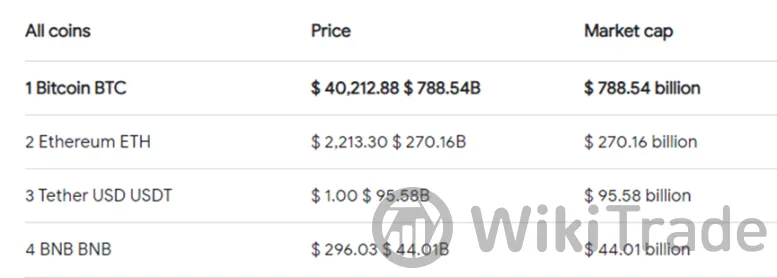

The total market capitalization of cryptocurrencies has reached an impressive milestone, currently standing at approximately $1.198 trillion. This figure highlights the remarkable growth and widespread adoption of digital assets in the financial landscape.

Bitcoin, being the pioneering cryptocurrency, holds the largest market cap at $788.54 billion. Its enduring popularity and recognition have solidified its position as the leading digital currency. Ethereum, with a market capitalization of $270.16 billion, has emerged as a formidable contender, offering a platform for decentralized applications and smart contracts.

Tether, a stable coin pegged to the value of the US dollar, has gained substantial traction, evidenced by its market cap of $95.58 billion. Its stability and utility as a medium of exchange within the crypto ecosystem have contributed to its widespread acceptance.

BNB, the native cryptocurrency of the Binance exchange, has shown remarkable growth, boasting a market capitalization of $44.01 billion. As the preferred token within the Binance ecosystem, BNB has gained popularity due to its utility in reducing transaction fees and participating in token sales.

What is Market capitalization of Crypto

(source: unsplash.com)

Market capitalization is also a widely used metric in the world of cryptocurrencies. In the realm of crypto, market capitalization is calculated similarly to traditional stocks, by multiplying the current price of a cryptocurrency by its total circulating supply. This calculation provides a figure that represents the overall value of a given cryptocurrency within the market.

As with stocks, market capitalization in the crypto space plays a crucial role in assessing the size and perceived value of a cryptocurrency. Cryptocurrencies with higher market capitalizations are often seen as more established and have a larger presence within the digital asset landscape. Bitcoin, for example, has consistently held the top position in terms of market capitalization, reflecting its status as the most established and widely recognized cryptocurrency.

Conversely, cryptocurrencies with lower market capitalizations may be viewed as smaller or emerging digital assets. These smaller-cap cryptocurrencies often present higher volatility and potential for growth, but they also carry increased risk due to factors such as limited liquidity and potentially less-established use cases.

Just as in traditional markets, investors in the cryptocurrency space commonly use market capitalization as a criterion for categorizing digital assets into different segments such as large-cap, mid-cap, and small-cap cryptocurrencies. Large-cap cryptocurrencies typically represent the most well-established and widely recognized digital assets, often with market capitalizations in the billions of dollars. Mid-cap cryptocurrencies are generally those with moderate market capitalizations, while small-cap cryptocurrencies represent the smaller, emerging digital assets.

Understanding the market capitalization of cryptocurrencies is essential for investors who are seeking to navigate the dynamic world of digital assets. By considering market capitalization alongside other fundamental and technical analysis tools, investors can gain valuable insights into the risk and potential return associated with different types of cryptocurrencies.

Famous examples of cryptocurrencies with significant market capitalizations include:

| Cryptocurrency | Main Functionality | Rank | Notable Features |

| Ethereum (ETH) | Smart Contracts | 2nd | Enables dApp development and token creation on its blockchain |

| Binance Coin (BNB) | Utility Coin | 4th | Offers trading fee discounts and utility within the Binance exchange ecosystem |

| Cardano (ADA) | Blockchain Platform | 5th | Provides secure and scalable infrastructure for decentralized applications and smart contracts |

| Ripple (XRP) | Digital Payment Protocol | 7th | Designed to facilitate fast and low-cost international money transfers, with focus on collaborating with banks and financial institutions |

How to evaluate the cap of crypto

When evaluating the market capitalization of a cryptocurrency, various factors, providing insights into the potential value and growth of the asset, are to be taken into consideration. Here are some of the main factors:

Market Dominance: Look at the cryptocurrency's market share within its specific category or niche. A higher market dominance generally indicates greater popularity and acceptance among investors.

Project Fundamentals: Evaluate the underlying technology and potential for adoption of cryptocurrency. Investigate the whitepaper, development team, partnerships, and roadmap to understand the project's long-term viability and potential for growth.

Trading Volume and Liquidity: Consider the trading volume and liquidity of cryptocurrency. Higher trading volume and liquidity suggest that cryptocurrency is actively traded and can be easily bought or sold without significantly affecting its price.

Community and Developer Activity: Assess the size and engagement of the community surrounding the cryptocurrency. Look for active communication channels, developer contributions, and community-driven initiatives that can contribute to the growth and adoption of the cryptocurrency.

Competitive Landscape: Evaluate the cryptocurrency's competitors and unique features to gain insights into its potential market share and growth prospects.

Regulatory Environment: Be aware of the regulatory environment in which cryptocurrency operates. Regulations can have a significant impact on adoption and value, so stay informed about any legal or regulatory developments that may affect cryptocurrency's future.

Technical Analysis: Use technical analysis techniques to assess cryptocurrency's historical price movements and patterns. Technical indicators and chart patterns can provide valuable insights into potential price trends and identify buying or selling opportunities.

The history of crypto capitalisation

The origin of cryptocurrencies can be traced back to the creation of Bitcoin in 2009, which was introduced by an individual or group known as Satoshi Nakamoto. Nakamoto outlined the concept of Bitcoin in a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” published in October 2008.

The precise identity of Satoshi Nakamoto remains unknown, but their contribution was significant in establishing the technology behind Bitcoin and the underlying blockchain network.

The evolution of cryptocurrency has brought about a transformation in the financial landscape, fundamentally changing our perception and approach to value transactions. Bitcoin quickly gained popularity among tech enthusiasts and libertarians in 2009, who recognized its potential as a decentralized digital currency. This marked the beginning of the cryptocurrency era and paved the way for the development of blockchain technology.

Here are the main stages of development of crypto: (source: unsplash.com)

Early Experimentation (2009-2012):

The birth of Bitcoin marked the beginning of the cryptocurrency era. Created by the mysterious Satoshi Nakamoto, Bitcoin gained traction among tech enthusiasts and libertarians who saw its potential as a decentralized digital currency. This stage was characterized by early experimentation with the technology, mining of Bitcoin, and the formation of a passionate community. It laid the foundation for blockchain technology and showcased the potential for a peer-to-peer electronic cash system.

Emergence of Altcoins and Market Expansion (2013-2016):

As Bitcoin gained prominence, alternative cryptocurrencies, or altcoins, began to emerge. These altcoins aimed to address perceived limitations of Bitcoin, such as scalability and transaction speed. Litecoin, Ripple, and Ethereum were notable examples that gained popularity during this period. The rise of altcoins led to increased adoption of cryptocurrencies as a medium of exchange. It also witnessed the development of exchanges and other infrastructure to facilitate trading, establishing cryptocurrency as a viable asset class.

ICO Boom and Regulatory Scrutiny (2017-2018):

The introduction of Initial Coin Offerings (ICOs) revolutionized fundraising for blockchain startups. ICOs enabled projects to raise capital by issuing their own tokens on existing blockchain platforms. However, this stage also witnessed instances of fraudulent projects and scams due to the lack of regulation and oversight. Governments and regulatory bodies worldwide responded by scrutinizing ICOs and implementing measures to protect investors. This period highlighted the need for clearer regulations and guidelines in the cryptocurrency space.

Crypto Winter and Institutional Adoption (2018-2019):

This stage was marked by a significant price decline across cryptocurrencies, leading to a period of consolidation and industry maturation. While some projects lacking fundamentals failed, others with strong foundations survived. Notably, institutional investors began recognizing the potential of cryptocurrencies and blockchain technology. Traditional financial institutions and corporations started investing in cryptocurrencies, bringing increased legitimacy to the industry. This institutional adoption paved the way for the development of sophisticated financial products, such as cryptocurrency futures and exchange-traded funds (ETFs).

DeFi and NFTs (2020-present):

The current stage is characterized by the emergence of decentralized finance (DeFi) platforms and non-fungible tokens (NFTs), expanding the utility and applications of cryptocurrencies. DeFi platforms enable users to access financial services like lending, borrowing, and yield farming without traditional intermediaries. NFTs revolutionize the ownership and trading of unique digital assets, including artwork, music, and virtual real estate. This stage witnesses increased mainstream adoption, with major companies and institutions investing in cryptocurrencies and blockchain technology. Governments worldwide are exploring the potential of central bank digital currencies (CBDCs) as alternatives to fiat currencies. Blockchain technology continues to disrupt various industries, showcasing its transformative potential.

How does online crypto trading affect crypto capitalisation

Crypto trading has become increasingly popular in recent years due to its accessibility. It involves buying, selling, and exchanging digital currencies through online platforms or exchanges, making it possible for individuals to trade cryptocurrencies from anywhere with an internet connection.

The emergence of digital platforms and exchanges dedicated to facilitating crypto trading has revolutionized the cryptocurrency market, significantly impacting its capitalization and overall dynamics. Online crypto trading has brought increased accessibility, liquidity, and market participation. One of the key ways it affects crypto capitalization is through enhanced liquidity. These platforms provide a convenient avenue for buyers and sellers to trade cryptocurrencies, creating a vibrant marketplace with a continuous flow of transactions.

As more participants engage in trading, the volume of trades increases, leading to higher liquidity levels. This increased liquidity not only facilitates smoother transactions but also attracts more investors to the market, potentially driving up crypto capitalization. In addition to liquidity, online trading platforms contribute to price discovery in the cryptocurrency market. The continuous buying and selling of cryptocurrencies on these platforms helps establish fair market prices based on supply and demand dynamics.

Traders actively participating in the market bring new information, perspectives, and trading strategies, which collectively influence the valuation of cryptocurrencies. Through this ongoing process of price discovery, the capitalization of the cryptocurrency market is continually adjusted and refined.

Online crypto trading platforms also play a crucial role in shaping market perception and sentiment. Traders and investors rely on these platforms to gather market data, analyze trends, and make informed decisions. Positive news, increased trading activities, and optimistic sentiment expressed through these platforms can generate enthusiasm and attract more participants to the market.

This influx of new investors potentially leads to an increase in demand for cryptocurrencies, positively impacting their capitalization. However, traders must exercise caution, conduct thorough research, and stay informed about regulatory developments and market trends as online crypto trading introduces certain risks. Nonetheless, it remains an exciting opportunity for profit and growth in the evolving landscape of cryptocurrencies.

Famous examples of crypto online trading

Winklevoss Twins: Cameron and Tyler Winklevoss gained notoriety for their involvement in the early development of Facebook. However, they later turned their attention to cryptocurrencies and became early adopters and investors in Bitcoin. Their investments paid off significantly, and they have since become prominent figures in the crypto industry.

Changpeng Zhao (CZ): CZ is the founder and CEO of Binance, one of the world's largest cryptocurrency exchanges. He has amassed a considerable fortune through his involvement in the crypto industry, building Binance into a multi-billion dollar company.

Vitalik Buterin: As the co-founder of Ethereum, the second-largest cryptocurrency by market capitalization, Vitalik Buterin has become a well-known figure in the crypto space. His contributions to the development of Ethereum and his early investments in cryptocurrency have positioned him as a wealthy individual.

Barry Silbert: Barry Silbert is the founder and CEO of Digital Currency Group, a company that has invested in numerous blockchain and cryptocurrency-related startups. Through his investments, Silbert has accumulated substantial wealth in the crypto industry.

When will crypto go back up

The cryptocurrency industry has witnessed a phenomenal resurgence in the past year, defying expectations and riding a new rally that enthusiasts believe will continue to surge even higher in 2024. Bitcoin (BTC-USD), the world's largest cryptocurrency, has experienced a meteoric rise in value this year, surging more than 160% and reaching an all-time high of over $44,000 for the first time since early 2022. The stock of Coinbase (COIN), one of the most popular cryptocurrency exchanges, has tripled in value, while the total market capitalization of all crypto assets has nearly doubled.

This remarkable turnaround in the crypto world comes as a surprise to many, given the devastating collapse it experienced in 2022. Many investors incurred significant losses, and several major players in the industry fell by the wayside. However, there is renewed optimism among investors, who believe that cryptocurrencies are on the cusp of wider acceptance and regulatory clarity from Washington.

One of the reasons for this optimism is the expectation that regulators will approve a series of spot bitcoin ETFs in January. These ETFs would enable everyday people to gain exposure to cryptocurrencies without actually owning them, potentially facilitating wider adoption of digital currencies. Investors are eagerly awaiting this development, which they believe will bring much-needed legitimacy to the crypto industry.

Another factor driving investor confidence is the upcoming “halving” event in the Bitcoin ecosystem, scheduled for April 2024. This event occurs once every four years and results in a halving of the daily issuance of Bitcoins. In the past, halving events have typically triggered another bull run, leading investors to anticipate further growth in the crypto market next year.

According to Farreel, vice president of digital asset strategy at Fundstrat Global Advisors, a perfect storm of positive tailwinds is aligning for the online crypto trading industry heading into 2024. These include the anticipated regulatory clarity and the prospect of Bitcoin ETFs, as well as the upcoming halving event. (source: Yahoo Finance)

Where can you check the coin price

If you're looking to check cryptocurrency prices, there are various websites and platforms available. Here are some popular options:

CoinMarketCap (coinmarketcap.com): a widely used platform that provides comprehensive cryptocurrency price data: real-time prices, market capitalization, trading volume, price charts, historical data, and a portfolio tracker feature. CoinMarketCap covers a vast number of cryptocurrencies and provides insights into market trends.

CoinGecko (coingecko.com): CoinGecko is another well-known website. It offers real-time market data, price charts, trading volume, and information about various cryptocurrencies. CoinGecko also provides additional features like coin comparisons, community-driven ratings, and a portfolio management tool.

Binance (binance.com): one of the largest cryptocurrency exchanges globally, along with trading services. Binance offers real-time price data, trading pairs, advanced charting tools, and customizable market watchlists. Binance is known for its extensive selection of cryptocurrencies and high liquidity.

Coinbase (coinbase.com): a popular cryptocurrency exchange that offers an easy-to-use interface for checking coin prices. It provides real-time prices, interactive charts, and historical data for a limited number of cryptocurrencies. Coinbase is recognized for its user-friendly experience and is a preferred choice for beginners.

Crypto.com (crypto.com): a comprehensive platform that offers various cryptocurrency service: price tracking. It provides real-time coin prices, market data, customizable alerts, and a portfolio management feature. Crypto.com also has its own native cryptocurrency, CRO, which offers additional benefits within the platform.

TradingView (tradingview.com): TradingView is a widely used platform for analyzing financial markets, including cryptocurrencies. It offers interactive price charts, technical analysis tools, and the ability to create and share custom indicators. TradingView is favored by traders and analysts due to its advanced charting capabilities.

Realisation of capitalisation: convert crypto into currency

(source: unsplash.com)

When the value of a cryptocurrency increases, individuals may choose to sell it for a fiat currency to realize their gains and withdraw the funds. Also, investors convert when theres a need to facilitate transactions for goods and services, for example: some businesses accept cryptocurrencies as payment. In this case, converting crypto into a fiat currency enables individuals to make purchases more conveniently, especially when dealing with merchants that don't accept digital assets.

How to convert cryptocurrency into another currency

Choose a cryptocurrency exchange: Select a reputable cryptocurrency exchange that supports the cryptocurrency you want to convert and offers trading pairs with the desired fiat currency. Some popular exchanges include Binance, Coinbase, Kraken, and Bitstamp.

Sign up and complete the verification process: Create an account on the chosen exchange and complete the necessary verification procedures. This typically involves providing identification documents to comply with Know Your Customer (KYC) requirements.

Deposit your cryptocurrency: Once your account is set up and verified, deposit the cryptocurrency you want to convert into your exchange wallet. The specific process for depositing varies between exchanges, but generally, you'll need to generate a deposit address for the cryptocurrency you're sending and initiate the transfer from your own wallet or another exchange.

Select the trading pair: After your cryptocurrency deposit has been confirmed and credited to your exchange account, navigate to the trading section of the platform. Choose the trading pair that corresponds to your cryptocurrency and the target fiat currency (e.g., BTC/USD for converting Bitcoin to US dollars).

Place a sell order: Enter the amount of the cryptocurrency you wish to convert and specify that you want to sell it for the desired fiat currency. Review the order details and confirm the transaction. Note that exchanges may charge fees for trades, so be aware of any associated costs.

Execute the trade: Once your sell order is placed, it will be matched with a buyer on the exchange. If the trade is successfully executed, you will receive the corresponding amount of fiat currency in your exchange account.

Withdraw the fiat currency: Finally, withdraw the converted fiat currency from your exchange account to your desired bank account or payment method. Each exchange has its own withdrawal process, which may involve additional verification steps.

Cautions you have to take:

Choose a reputable cryptocurrency exchange: Select a well-established and trusted cryptocurrency exchange that supports the specific cryptocurrency you want to convert and offers trading pairs with the desired fiat currency. Some popular exchanges include Binance, Coinbase, Kraken, and Bitstamp.

Sign up and complete the verification process: Create an account on the chosen exchange and go through the necessary verification procedures. This typically involves providing identification documents to comply with Know Your Customer (KYC) requirements.

Deposit your cryptocurrency: Once your account is set up and verified, deposit the cryptocurrency you wish to convert into your exchange wallet. The exact process for depositing varies between exchanges, but generally, you'll need to generate a deposit address for the cryptocurrency you're sending and initiate the transfer from your own wallet or another exchange.

Select the trading pair: After your cryptocurrency deposit has been confirmed and credited to your exchange account, navigate to the trading section of the platform. Choose the trading pair that corresponds to your cryptocurrency and the target fiat currency (e.g., BTC/USD for converting Bitcoin to US dollars).

Place a sell order: Enter the amount of the cryptocurrency you want to convert and indicate that you wish to sell it for the desired fiat currency. Review the order details and ensure their accuracy before confirming the transaction. Keep in mind that exchanges may charge fees for trades, so be aware of any associated costs.

Execute the trade: Once your sell order is placed, the exchange will match it with a buyer. If the trade is successfully executed, you will receive the corresponding amount of fiat currency in your exchange account.

Top News

WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade WikiTrade

WikiTrade